The Dow took a 12 point haircut today

The major benchmarks kicked the week off on a quiet note, with all three logging paltry performances as U.S. Treasury yields moved higher while investors look ahead to a big week of retail earnings. The rise in Treasury yields comes after last week's sale by Tesla's CEO Elon Musk of nearly $7 billion shares of the stock. The tech giant's drag continued into Monday, sinking around 3.5% during today's session. In response, the Dow shed 12 points, while the S&P 500 and Nasdaq also finished near their respective breakeven marks.

Continue reading for more on today's market, including:

- Don't sweat Hilton Hotels stock's pullback.

- Auto parts stock trades at record highs ahead of key event.

- Plus, Credit Suisse weighs in on EVGO; Mantle Ridge takes stake in Dollar Tree; and Petco stock nabs a bear note.

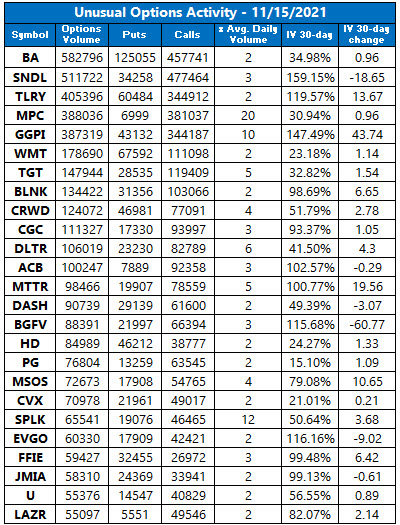

The Dow Jones Average (DJI - 36,087.45) fell 12.9 points or 0.04% for the day. The best performing Dow member today was Boeing (BA), which added 5.5%. UnitedHealth (UNH), meanwhile, fell 1.8%, to pace the laggards.

The S&P 500 Index (SPX - 4,682.80) lost 0.05 point, or 0% for the day, while the Nasdaq Composite (IXIC - 15,853.85) shed 7.1 points, or 0.04% for the day.

Lastly, the CBOE Market Volatility Index (VIX - 16.49) added 0.2 point, or 1.2% for the day.

- Airline travelers are flooding terminals once again, but the rising cost of jet fuel is reportedly threatening the industry's profitability. (CNBC)

- U.S. President Joe Biden is slated to sign the bipartisan infrastructure bill into law today. (MarketWatch)

- Are EVgo stock's tailwinds already priced in?

- Mantel Ridge took a billion-dollar stake in this discount retailer.

- Jefferies downgrades Petco stock.

Oil Brushes Off Fears of Supply Issues

Oil prices in the U.S. rose slightly to kick of the week, brushing aside higher supply forecasts. The market for crude has cooled off recently, as the White House ponders releasing oil from the U.S. Strategic Petroleum Reserve in order to ease skyrocket prices. December-dated crude added 9 cents, or 0.1% to settle at $80.88 a barrel today.

Gold prices fell, snapping a seven-day win streak after U.S. bond yields moved higher. However, bullion stayed near its five-month highs, thanks to its continual appeal as an inflation hedge. December-dated gold shed $1.90 or, 0.1%, to settle at $1,866.60 on the day.