The Dow logged its best day since July 20

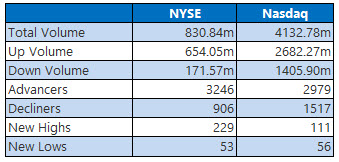

Stocks saw a notable surge today, with the Dow scoring a 534-point pop, its largest single-session gain since July 20. The S&P 500 logged its best win since March 5, while and Nasdaq tallied its best day since May 20. With another earnings season now in full swing, well-received reports from Bank of America (BAC) and Morgan Stanley (MS) are helping boost sentiment on Wall Street. Elsewhere, the 10-year Treasury yield cooled off, giving the broader tech sector a lift.

On the data front, a round of weekly jobless claims came in at 293,000, marking the first time that number has fallen below 300,000 since the pandemic began. Meanwhile, September's producer price index (PPI) came in at a slimmer-than-expected 0.5%, though it still rose for the month. Amid all this optimism, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), logged its third straight loss and lowest close since Sept. 3.

Continue reading for more on today's market, including:

- See why this pharma stock is buzzing.

- These 2 retail stocks should be avoided right now.

- Plus, the best type of stock for every portfolio; a homebuilding stock to watch; and Netflix gears up for earnings.

The Dow Jones Average (DJI - 34,912.56) gained 534.75 points. Walgreens Boots Alliance (WBA) paced the gainers with a 7.4% pop, while Boeing (BA) fell to the bottom, shedding nearly 2%.

The S&P 500 Index (SPX - 4,438.26) added 74.5 points, or 1.7% for the day, and the Nasdaq Composite (IXIC - 14,823.43) tacked on 251.8 points, or 1.7% for the day.

Lastly, the Cboe Volatility Index (VIX - 16.86) shed 1.8 point, or 9.6%.

- The House panel in charge of investigating the Jan. 6 Capitol riot said in a press release that it will convene on Tuesday and move to refer former Trump advisor Steve Bannon for criminal contempt, following his noncompliance with a subpoena. (CNBC)

- Coinbase (COIN) on Thursday released a proposal asking Congress to reform U.S. federal regulation of digital assets by creating a new agency, which would regulate the industry under different guidelines. (MarketWatch)

- A comprehensive guide on picking the best types of stocks for your portfolio.

- The homebuilding underdog investors should keep an eye on.

- Checking out Netflix stock ahead of another closely watched earnings report.

Gold Briefly Tops $1,800 Mark, Nabs 3rd-Straight Gain

Oil prices hit another seven-year high today. The commodity got a boost from the International Energy Agency's hiked global oil-demand forecast for this year and next, as reliance on crude strengthens in the face of the energy shortage. Additional gains, however, were capped by this week's Energy Information Administration (EIA) data, showing a third-straight rise in U.S. crude inventories to 6.1 million barrels. In turn, November-dated crude rose 87 cents, or 1.1%, to settle at $81.31 a barrel.

Gold prices strung together a third-straight day of wins, and briefly topped the $1,800 mark during intraday trading, as inflation fears send more investors looking for shelter with the safe-haven. December-dated gold rose $3.20, or 0.2%, to settle at $1,797.90 an ounce for the day.