Better-than-expected initial jobless claims for last week gave the market a boost

The Dow finished the day up 131 points, snapping a three-day losing streak, while the S&P 500 and Nasdaq both eked out record closes. Ahead of tomorrow's highly anticipated August jobs report, initial jobless claims for last week came in at 340,000 -- a new pandemic-era low and below analyst estimates of 345,000. Elsewhere, U.S. factory orders rose a higher-than-expected 0.4% in July.

Continue reading for more on today's market, including:

- Pizza name with promising returns in September, historically.

- Why Oracle stock looks like a good pick for bulls.

- Plus, what analysts have to say about FIVE; WKHS attempts to bounce back; and a listen in on our latest Market Mashup podcast.

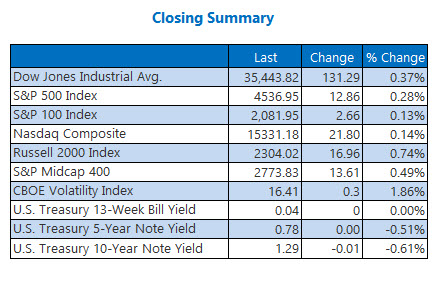

The Dow Jones Average (DJI - 35,443.82) gained 131.3 points, or 0.4%. Walgreens Boots Alliance (WBA) led the Dow winners today with a 3% gain, while Visa (V) paced the laggards with a 2.6% loss.

The S&P 500 Index (SPX - 4,536.95) added 12.9 points, or 0.3%, while the Nasdaq Composite (IXIC - 15,331.18) jumped 21.8 points, or 0.1%.

Lastly, the Cboe Volatility Index (VIX - 16.41) rose 0.3 point, or 1.9%.

- The bipartisan infrastructure bill mandates new technology to prevent drunk driving, involving a breath or touch-based function. (MarketWatch)

- Looking back at the scope of the $794 billion in unemployment benefits during the pandemic. (CNBC)

- Behind FIVE's plummet following its mixed second-quarter report.

- Checking in on Workhorse stock after yesterday's investigation news.

- If you haven't already, check out the most recent Schaeffer's Market Mashup, featuring Schaeffer's Senior V.P. of Research Todd Salamone.

Oil Jumps to Highest Level in a Month

Oil prices rose to their highest level in a month, despite the commodity grappling with a drop in inventory on the heels of Hurricane Ida and newCovid-19 variants. October-dated crude rose $1.40, or 2%, to settle at $69.99 a barrel.

Gold prices fell for the second day, as investors await tomorrow's jobs data for direction. December-dated gold lost $4.50, or nearly 0.3%, to settle at $1,811.50 an ounce.