The Dow is up 271 points this afternoon

The Dow Jones Industrial Average (DJI) is up 271 points at midday, extending this morning's gains as investors speculate on this week's annual Jackson Hole monetary policy symposium, in which Federal Reserve Chairman Jerome Powell will provide commentary. The Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are firmly in the black as well, after earlier notching fresh intraday highs. On the data front, the IHS Markit flash U.S. composite index fell to an eight-month low of 55.4, while existing home sales for July rose 2% to an adjusted annual rate of 5.99 million, which is higher than analysts' expected 5.83 million.

Continue reading for more on today's market, including:

- PayPal stock expands its crypto reach.

- Coinbase stock climbs as Bitcoin breaks higher.

- Plus, TRIL options surge after buyout; VVOS soars on FDA approval; and MKTW hits new all-time-low.

Trillium Therapeutics Inc (NASDAQ:TRIL) is seeing a surge of options activity today, after news that Pfizer (PFE) will acquire the cancer drug developer for $18.50 per share in a $2.3 billion deal. So far, 13,000 calls and 50,000 puts have crossed the tape, which is 401 times what's typically seen at this point. Most popular by far is the September 15 put, where new positions are being opened. At last check, TRIL is up 187.3% to trade at $17.49, or its highest level since December. Over the last three months, the equity has added 118.5%.

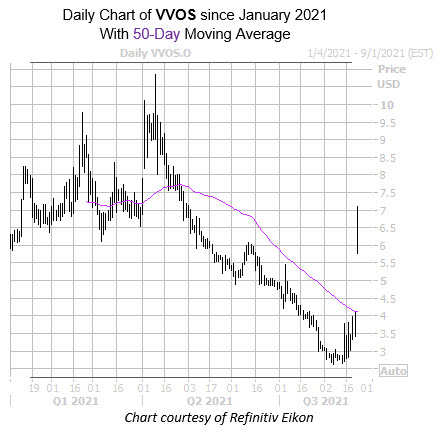

Vivos Therapeutics Inc (NASDAQ:VVOS) is also towards the top of the Nasdaq today, last seen up 78.4% to trade at $6.85, after the U.S. Food and Drug Administration (FDA) approved its mmRNA device for treating obstructive sleep apnea (OSA) in adults. This bull gap has Vivos Therapeutics stock breaking out above the 50-day moving average, which capped the equity's gains in the previous session. Quarter-to-date, VVOS is up 12.5%.

Conversely, Marketwise Inc (NASDAQ:MKTW) is sinking, down 14.4% at $6.98 at last check, though the reason for this negative price action is unclear. Since MKTW's July 30 record high of $16.97, the equity has only posted three daily wins. Today, the security is on track for its fourth-straight loss, after hitting a new all-time low of $6.90. Year-to-date, MKTW is off roughly 32%.