The Fed is eyeing tapering economic stimulus by the year's end

The Dow logged its third-straight drop today, falling 66 points to pare earlier triple digit losses, as the Federal Reserve's comments about removing stimulus revealed in the central bank's latest meeting minutes, continued to grip Wall Street. Digging deeper, the Fed's July meeting showed plans to begin slowly shedding $120 billion in monthly bond purchases by the end of 2021. Meanwhile, the S&P 500 and the Nasdaq both clung to midday gains to finish just above breakeven.

However, pessimism was kept in check by positive unemployment data, with first-time jobless claims hitting a new pandemic-era low. Lastly, the Cboe Volatility Index (VIX) fell into the red in the final hour of trading, but is pacing for its biggest week since January.

Continue reading for more on today's market, including:

- Options bears blast DoorDash stock after massive sale.

- Robinhood stock dips after company issues dire warning.

- Plus, unpacking Kohl's earnings; one FAANG stock's lofty bull note; and why Cisco stock is getting so much attention.

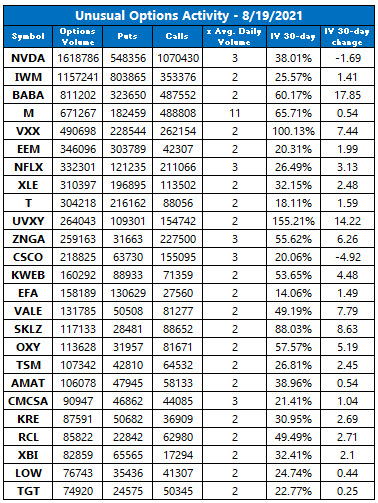

The Dow Jones Average (DJI - 34,894.12) fell 66.6 points, or 0.2% for the day. Cisco Systems (CSCO) led the list of Dow winners today, adding 3.8%, while Boeing (BA) paced the laggards with a 3.1% drop.

The S&P 500 Index (SPX - 4,405.80) rose 5.5 points, or 0.1% for the day. Meanwhile, the Nasdaq Composite (IXIC - 14,541.79) gained 15.9 points, or 0.1%, for the day.

Lastly, the Cboe Volatility Index (VIX - 21.67) fell 0.1 point, or 0.5%, for the day.

- Automakers are transitioning to cleaner vehicles, but the switch comes with some costly risks. (CNBC)

- U.S. President Joe Biden announced states that want to provide extra jobless benefits beyond the September cutoff, will be able to do so. (MarketWatch)

- Retail giant jumps higher after earnings.

- J.P. Morgan Securities hits Apple stock with a price-target hike.

- Why options traders and analysts love semiconductor leader.

Oil Falls to Lowest Level Since May

Oil prices fell to their lowest level since May, closing their sixth-straight session in the red, as demand fears and comments from the Federal Reserve weighed on Wall Street. Specifically, the central bank's announcement that it will suspend its bond-buying program strengthened the U.S. dollar, ultimately denting black gold's appeal. In response, September-dated crude lost $1.77, or 2.7%, to settle at $63.69, its lowest settlement since May.

Sentiment surrounding gold was also impacted by the strengthening dollar and early stimulus tapering. However, losses were kept in check as rising global Covid-19 cases stoked concerns of slowing global growth. December-dated gold shed $1.30, or 0.07%, to settle at $1,783.10 an ounce today.