The Cboe Volatility Index logged its third-straight loss

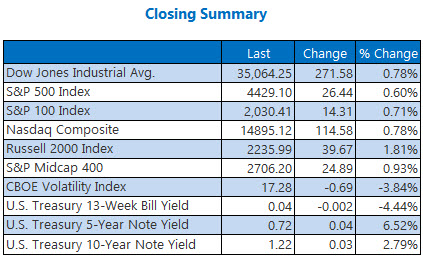

The Dow scored a triple digit pop today, rising 271 points as energy and travel stocks rebounded ahead of a pivotal July jobs report. After yesterday's ADP private payroll survey showed job gains lower than consensus estimates, some investors fear of downside risk to tomorrow's report. The S&P 500 and Nasdaq both finished with record closes, with the latter logging its fourth-straight win. Elsewhere, the Cboe Volatility Index (VIX) logged its third-straight loss and lowest close since July 23.

Continue reading for more on today's market, including:

- Target these two mining ETFs in August.

- Fastly stock bombarded with bear notes.

- Plus, DraftKings steps up to earnings plate; Roku's dismal user growth; and one e-learning stock set to soar.

The Dow Jones Average (DJI - 35,064.25) rose 271.6 points, or 0.8% for the day. Of the 30 Dow components, Salesforce.com (CRM) topped the long list of Dow winners today, adding 2.6%, while UnitedHealth (UNH) paced the three laggards with a 2.6% dip.

The S&P 500 Index (SPX - 4,429.10) gained 26.4 points, or 0.6% for the day. Meanwhile, the Nasdaq Composite (IXIC - 14,895.12) added 114.6 points, or 0.8%, for the day.

Lastly, the Cboe Volatility Index (VIX - 17.28) shed 0.7 point, or 3.8%, for the day.

- Crypto supporters in the U.S. Senate filed an amendment to the bipartisan infrastructure bill, making clear that miners and providers of crypto services will be exempt from new tax-reporting rules. (MarketWatch)

- AFL-CIO President Richard Trumka died today at the age of 72. (CNBC)

- DraftKings stock is in focus ahead of earnings.

- Weak user growth and tight margins drag Roku stock down.

- Covid-19 worries mean more upside for this e-learning stock.

Oil Prices Rise Amid Increased Tension in the Middle East

Oil prices snapped a three-day losing streak today, rising alongside escalating tensions in the Middle East. Israeli jets target rocket launch sites in Lebanon, while tensions with Iran remain heightened. Meanwhile, new restrictions imposed in certain countries in response to rising Covid-19 cases threatened the recovery in black gold's demand. As a result, September-dated crude added 94 cents, or 1.4%, to settle at $69.09 a barrel.

Elsewhere, hawkish comments from the Federal Reserve dragged gold prices down to test the psychological $1,800 level. The comments reinforced bets for an earlier-than-expected tapering of the Fed's asset purchases. In response, December-dated gold, the most active contract, shed $5.60, or 0.3%, to settle at $1,808.90 an ounce.