The Dow settled with a 71-point drop

It was a mixed day for markets, with the Dow dropping 71 points, after spending most of the afternoon modestly below breakeven. The S&P 500, meanwhile, failed to snatch a three-day win, but remained close to all-time high territory. The tech-rich Nasdaq was a standout, surging to another record close, as Big Tech outperformed alongside the energy sector. Optimism over Federal Reserve Chairman Jerome Powell's assurances that inflation pressure will only be temporary also helped boost stocks today, with the central bank leader adding that recent inflation should resolve itself in the coming months.

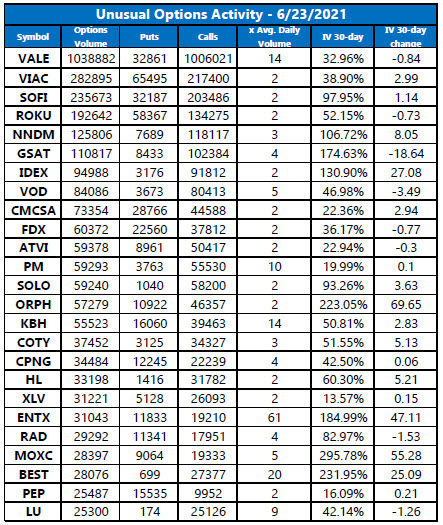

Continue reading for more on today's market, including:

- This promising retail stock sports affordable options right now.

- Why ENTX's options pits turned red-hot today.

- Plus, a pre-earnings play for bulls; GSK stages a bounce; and all about Shake Shack's China expansion.

The Dow Jones Average (DJI - 33,874.24) shed 71.3 points, or 0.2% for the day. Of the 30 Dow components, Walt Disney (DIS) saw the biggest jump, adding 1.1%, while 3M (MMM) fell to the bottom, shedding 1.4%.

Meanwhile, the S&P 500 Index (SPX - 4,241.84) dropped 4.6 points, or 0.1%. The Nasdaq Composite (IXIC - 14,271.73) added 18.5 points, or 0.1% for the day.

Lastly, the Cboe Volatility Index (VIX - 16.32) dropped 0.3 point, or 2%.

- Amazon.com's (AMZN) Prime Day sale ended on Tuesday, with the e-tail giant saying its third-party sellers sales saw wider growth than its first-party retail business. (CNBC)

- Donut maker Krispy Kreme will soon be going public, after raising $600 million through an offer of 26.7 million shares, with shares expected to be priced between $24 and $27. The company, which will use the ticker DNUT, was previously public between 2000 and 2016. (MarketWatch)

- The security stock bulls might want to snag ahead of its August earnings report.

- The spin-off news that helped GlaxoSmithKline stock stage a bounce.

- Shake Shack is expanding in China, and its giving the fast food chain's stock a boost.

There are no earnings of note today.

5th-Straight Drop in Supplies Pushes Oil Higher

Oil prices got a big boost today on news that U.S. crude inventories fell for their fifth-straight week, declining by almost eight million barrels, which was slightly larger than expected. As a result, the now most-active, August-dated contract added 23 cents, or 0.3%, to settle at $73.08 per barrel.

Gold prices staged an impressive rally on Wednesday, as the U.S. dollar weakened from its two-month peak, and investors grapple with the Fed's next possible monetary decision. In turn, August-dated gold added $6, or 0.3%, to settle at $1,783.40 an ounce -- marking its highest settlement since June 16.