The Nasdaq erased its earlier gains

A highly anticipated update from the Federal Reserve came out this afternoon, pulling the major indexes down with it. The Federal Open Market Committee (FOMC) signaled at least two interest rate hikes could happen as soon as 2023 -- much sooner than its initial time frame. The central bank also lifted its headline inflation forecast to 3.4% for 2021, though it noted recent inflation headwinds are "transitory." The Dow lost 265 points, while the S&P 500 sank deeper into the red, and the Nasdaq erased earlier gains.

While there was no discernable clues as to when the Fed will ease up on its aggressive bond buying program, Fed Chairman Jerome Powell was able to lift spirits after he said these new projections should be taken with a "big grain of salt," urging investors to focus on the here and now.

Continue reading for more on today's market, including:

- Buy this blue-chip bank stock before the bounce, says signal.

- Solar power stock shines through after analyst bull note.

- Plus, SQ eyes comeback; 2 cruise stocks sailing higher; and analysts chime in on NKE.

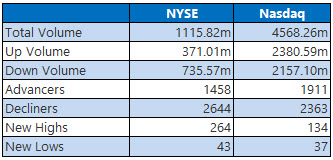

The Dow Jones Average (DJI - 34,033.67) lost 265.7 points, or 0.8% for the day, marking its third-straight drop. Merck & Co (MRK) led the Dow components with a 1.2% rise, while Dow Inc (DOW) paced the laggards, falling 2.4%.

Meanwhile, the S&P 500 Index (SPX - 4,223.70) lost 22.9 points, or 0.5%. The Nasdaq Composite (IXIC - 14,039.68) dropped 33.2 points, or 0.2% for the day.

Lastly, the Cboe Volatility Index (VIX - 18.15) marked its highest close in three weeks, adding 1.1point, or 6.6%.

- Intel (INTC) said it expects at least a decade of growth in the semiconductor space during CNBC's Evolve conference, suggesting its investments in chip production will create capacity beyond the current global microchip shortage. (CNBC)

- U.S. President Joe Biden told Russian President Vladimir Putin on Wednesday that critical infrastructure should be off limits to cyberattacks, providing the leader with a list of 16 entities, which included energy and water systems. (MarketWatch)

- Why struggling Square stock is primed for a comeback.

- Brokerage firm eyes the cruise sector amid economic reopening.

- What analysts are saying about NKE as China demand dwindles.

Drop in Crude Inventories Gives Oil Prices a Boost

Oil prices inched higher today, rising to their highest level in more than two years, after the Energy Information Administration (EIA) posted a bigger-than-expected one-week drop in crude inventories. A strong U.S. dollar, bolstered by the Fed's comments, may have kept additional gains in check. As a result, July-dated crude added 3 cents, or 0.04%, to settle at $72.15 per barrel.

Meanwhile, gold prices snapped their three-day losing streak, amid news that China's National Food and Strategic Reserves Administration would release some of its national reserves, including copper, aluminum, and zinc, to ensure bulk commodity prices remain stable. The precious metal did shift lower in after-hours trading, however, pressured by the Fed update. August-dated gold added $5, or 0.3%, to settle at $1,861.40 an ounce.