The Dow, meanwhile, added 13 points

After a day spent clinging close to its breakeven, the S&P 500 managed to eke out a win on Friday, just barely logging its second-straight record closing high. The Nasdaq also settled slightly higher, and both indexes notched weekly wins. The Dow, meanwhile, turned positive within the final few minutes trading, though it suffered a loss for the week. Tech stocks saw a resurgence today, while a drop in the 10-year Treasury yield to a three-month low, helped boost sentiment on Wall Street.

Continue reading for more on today's market, including:

- 3 names that lead today's meme stock frenzy.

- Why 1 analyst thinks Snowflake stock could melt this summer.

- Plus, analysts chime in on BIIB; what's going on with large-cap stocks; and 2 surging pot stocks.

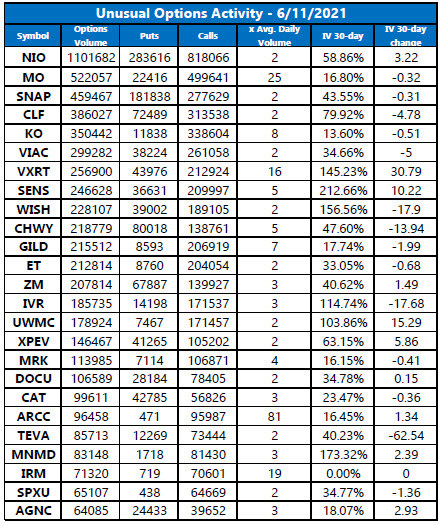

The Dow Jones Average (DJI - 34,479.60) added 13.4 points, or 0.04% for the day, but lost 0.8% for the week. American Express (AXP) led the Dow components with a 1.4% rise, while Caterpillar (CAT) paced the laggards, falling 2.2%.

Meanwhile, the S&P 500 Index (SPX - 4,247.44) added 8.3 points, or 0.2% for the day, and 0.4% for the week. The Nasdaq Composite (IXIC - 14,069.42) added 49.1 points, or 0.4% for the day, and 1.9% for the week. The former logged its third-straight weekly win, while the latter just strung together four weeks of consecutive gains.

Lastly, the Cboe Volatility Index (VIX - 15.65) dropped 0.5 point, or 2.8%, and shed 4.7% for the week.

- A new set of antitrust reforms could force several big tech names, including Amazon.com (AMZN), Facebook (FB), and Apple (AAPL) to overhaul their business practices, as it would make completing mergers and owning business lines with clear conflicts of interest more difficult. (CNBC)

- Restrictions for overnight summer camps in all 50 U.S. states have been lifted, though Covid-19 rules and a labor shortage could keep the number of campers attending these camps to a minimum. (MarketWatch)

- What analysts are saying about Biogen's controversial Alzheimer's drug.

- How the Reddit-fueled rally is distracting traders from what's going on with large-cap stocks.

- The two cannabis stocks that scored triple-digit gains this week.

EIA Prediction Sends Oil Prices Even Higher

Oil prices strung on another close above the $70 level on Friday, buoyed by comments from the International Energy Agency (IEA) predicting that oil demand will return to pre-pandemic levels by the end of 2022. The agency added that producers will need to up their production output to keep up with the demand. July-dated crude added 62 cents, or 0.9%, to settle at $70.91 per barrel, with an almost 1.9% rise for the week.

Gold prices fell to their lowest level in over a week, while the dollar hardened, and short-term futures traders began to take profits. August-dated gold dipped $16.80 cents, or 0.9%, to settle at $1,879.60 an ounce for the day, with a 0.7% drop for the week.