The Dow and Nasdaq are sporting triple-digit gains at midday

The major benchmarks are bouncing back from yesterday's mediocre price action, thanks to a better-than-expected drop in the unemployment rate, as well as encouraging jobs data for May. The Dow Jones Industrial Average (DJI) is up 113 points at midday, while the S&P 500 Index (SPX) is also firmly in the black, while sitting just one percentage point away from a fresh record. The tech-heavy Nasdaq Composite (IXIC) is also sporting triple-digit gains, after the 10-year Treasury yield pulled back slightly. For the week, all three indexes are eyeing modest gains.

Continue reading for more on today's market, including:

- Options trader blasted this semiconductor stock after earnings.

- Analysts are split on Lululemon stock following its quarterly results.

- Plus, DOCU options pop on raised outlook; SemiLEDs stock surges to 9-year high; and energy name plummets on adjusted Q4 losses.

One stock seeing an unusual amount of options activity today is Docusign Inc (NASDAQ:DOCU), last seen up 15.1% to trade at $224.22. The company last night reported blowout first-quarter earnings. Despite a slew of bear notes, 90,000 calls have crossed the tape so far -- more than double the number of puts exchanged and 14 times the intraday average. Most popular is the 6/4 220-strike call, followed by the 225-strike call in the same weekly series, with new positions being opened at both. Year-over-year, DOCU is up 58.7%, and the stock is set to clear its 40-day moving average for the first time since early May.

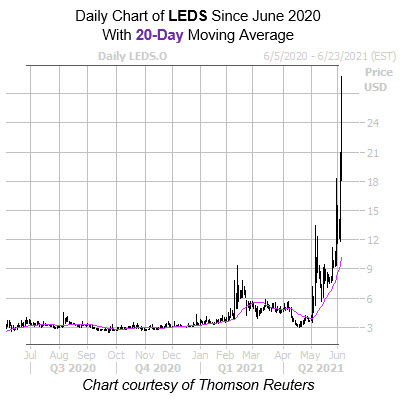

Near the top of the Nasdaq today is SemiLEDs Corporation (NASDAQ:LEDS). The security is up 70.5% at $25.74 at last check, after hitting a nine-year high of of $28.80 earlier today, though a reason for today's surge was not immediately clear. The shares have been carving a channel of higher highs since early May, with support from the 20-day moving average. Longer term, the security sports a whopping 729.5% year-over-year lead.

Meanwhile, one of the worst stocks on the New York Stock Exchange (NYSE) is NGL Energy Partners LP (NYSE:NGL). The security is down 22.8% at $2.42 at last check, after it adjusted its fourth-quarter losses to show an even wider gap, due to winter storms that lowered volumes in all areas of its operating segments. The equity yesterday surged to its highest trading level since January, while today's dip seems to have been captured by the 20-day moving average. In the last 12 months, NGL has shed approximately 62%.