The Dow wrapped up its 125th birthday near breakeven

Reopening plays were front and center on Wednesday, bolstering the broader market as Covid-19 infections dropped to their lowest level in almost a year, and new data showed roughly half of the U.S. population is at least partially vaccinated. The Dow wrapped up its 125th anniversary on a whisper, settling just north of breakeven. Meanwhile, both the S&P 500 and Nasdaq logged modest gains.

Bitcoin saw a relatively muted day as well, as it continues to contend with the $38,000 mark. Elsewhere, investors closely monitored infrastructure talks in Washington, which could give the economy further support. Lawmakers are working to reach a compromise, with Republicans planning on sending U.S. President Joe Biden a roughly $1 trillion counteroffer this week.

Continue reading for more on today's market, including:

- Amazon barrels into Hollywood on a billion-dollar buyout.

- An electric car initiative pushed Ford stock to a five-year high.

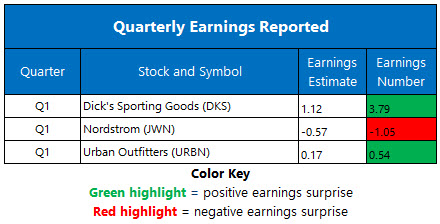

- Plus, RCL to start running test cruises; analysts size up URBN; and why options bulls blasted DKS.

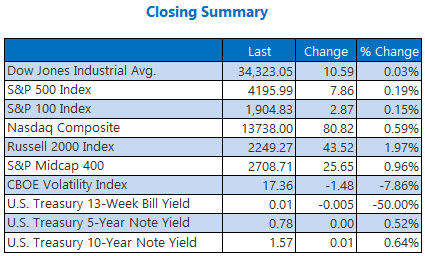

The Dow Jones Average (DJI - 34,323.05) added 10.6 points, or 0.03% for the day. Nike (NKE) led the Dow components with a 1.9% rise, while Walgreens Boots Alliance (WBA) paced the laggards, falling 4%.

Meanwhile, the S&P 500 Index (SPX - 4,195.99) rose 7.9 points, or 0.2% for the day. The Nasdaq Composite (IXIC - 13,738.00) added 80.8 points, or 0.6% for the day.

Lastly, the Cboe Volatility Index (VIX - 17.36) lost 1.5 point, or 7.9% for the day.

- Republican lawmakers are calling for Dr. Anthony Fauci to be fired over what they claim is a position shift on whether the U.S. funded research at the Wuhan Institute of Virology. (CNBC)

- Airbnb (ABNB) CEO Brian Chesky said the Covid-19 pandemic has changed travel sector, and added he is planning a "systematic update on pricing." (MarketWatch)

- Royal Caribbean stock popped after announcing test cruises out of Miami.

- Analysts eyed Urban Outfitters stock after a quarterly sales surge.

- Options bulls targeted this sports retailer following its quarterly win.

There is no Unusual Volume data due to technical difficulties. We apologize for the inconvenience.

Gold Notches First Close Above $1,900 Since January

Oil prices edged higher on Wednesday to notch a fourth consecutive win. Boosting the commodity was a drop in weekly U.S. crude and gasoline supplies, which helped traders brush off concerns that Iranian oil may soon reenter the market, as negotiations over a nuclear deal continue. In turn, July-dated crude added 14 cents, or 0.2%, to settle at $66.21 per barrel.

Gold prices were higher as well, settling above the significant $1,900 level for the first time since January, and turning positive for the year. Inflation concerns, as well as weakening Treasury yields were the main contributors to the precious metal's latest accomplishments. For the day, June-dated gold added $3.20, or 0.2%, to settle at $1,901.20 an ounce.