All three benchmarks have given back modest gains

The major indexes have pared most of their pre-market gains, giving way to a somewhat static afternoon. The Dow Jones Industrial Average (DJI) was last seen down 23 points after waffling at breakeven for the better part of the morning. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also struggling for direction, as some of the optimism tied to the economic reopening fades, while traders monitor Bitcoin's (BTC) volatile run. At last check, the cryptocurrency is facing off with the $38,000 mark following an announcement from Tesla (TSLA) CEO Elon Musk regarding bitcoin miners' sustainability.

Continue reading for more on today's market, including:

- Moderna's Covid-19 vaccine just crossed another milestone.

- Why Canopy Growth stock could be a promising play.

- Plus, another weed stock in focus; and two penny stocks dancing with key trendlines.

Cannabis concern Tilray Inc (NASDAQ:TLRY) is seeing a surge in options activity today. So far, 88,000 calls and 12,000 puts have crossed the tape -- double the intraday average. Most popular is the weekly 5/28 16-strike call, followed by the 17-strike call in the same series. Positions are being opened at the former. Tilray stock is up 9.2% at $16.41 at last check, though pressure at its 30-day moving average, which has acted as a ceiling since March, is keeping some of these gains in check.

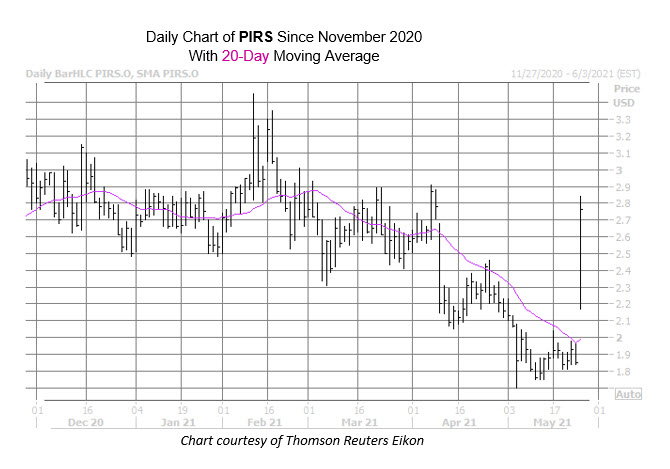

Penny stock Pieris Pharmaceuticals Inc (NASDAQ:PIRS) is one of the top names on the Nasdaq today. PIRS was last seen up 36.8% to trade at $2.53, after the company announced a collaboration deal with Genentech. The company is set to receive $20 million upfront as part of the deal, and could receive over $1.4 billion in milestone payments across several of its programs. The equity is set to clear multiple trendlines thanks to the pop, including its 20-day moving average, which has kept a lid on PIRS since early April.

Fellow penny stock and sector peer Petros Pharmaceuticals Inc (NASDAQ:PTPI) on the other hand, is one of the worst performing names on the Nasdaq. At last glance, PTPI is off 16.1% at $3.45. Though the reasons for this drop aren't immediately clear, the stock has been incredibly volatile lately, surging to a three-month high early last week before quickly dropping back below its 80-day moving average -- a trendline that's acted as a ceiling since forming in March. Yesterday's session put PTPI back above the moving average briefly, but now the stock is eyeing more pressure at the level.