The Dow logged a triple-digit loss as bitcoin plummeted

Though the major indexes managed to cut some of their steeper intraday losses, bitcoin's major selloff still left stocks settling deep in the red on Wednesday. The Dow logged a 164-point drop, after falling 586 points at its session lows. Both the S&P 500 and tech-heavy Nasdaq rose slightly from their intraday lows as well, but ultimately registered losses. Bitcoin did see a slight bounce this afternoon, and is now trading closer to the $40,000 mark, though the cryptocurrency's wild moves have cast a somber mood over Wall Street.

In other news, Federal Reserve Chairman Jerome Powell said a notable pickup in economic recovery would be grounds for tightening monetary policies in the next few months, but that it's still "uneven and far from complete." Regardless, investors remain on high alert, as the possibility of an adjusted fiscal policy solidifies.

Continue reading for more on today's market, including:

- A blowout quarterly win pushed Target stock to a fresh record.

- CarMax stock got slammed with a hefty Wedbush bear note.

- Plus, one chemical name to buy on the dip; AZN pops on Covid-19 booster buzz; and Lowe's stock dips despite earnings beat.

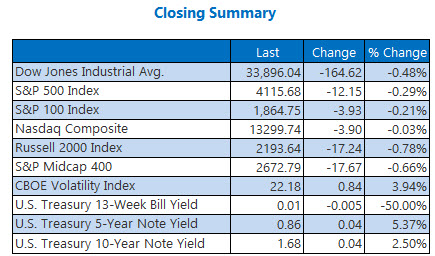

The Dow Jones Average (DJI - 33,896.04) dropped 164.6 points, or 0.5% for the day. Salesforce.com (CRM) led the Dow components with a 3.3% rise, while Chevron (CVX) paced the laggards, falling 2.8%.

Meanwhile, the S&P 500 Index (SPX - 4,115.68) fell 12.2 points, or 0.3% for the day. The Nasdaq Composite (IXIC - 13,299.74) shaved 3.9 points, or 0.03% for the day.

Lastly, the Cboe Volatility Index (VIX - 22.18) added 0.8 point, or 3.9% for the day.

- Ford (F) will halt or reduce the production of multiple vehicles at eight North American plants due to the ongoing global semiconductor shortage. (CNBC)

- Thousands of doctors in Japan are urging Prime Minister Yoshihide Suga to cancel the Tokyo Olympics, due to risks of increasing of Covid-19 infections and deaths. (MarketWatch)

- Here why bulls should take advantage of this chemical concern's latest dip.

- AstraZeneca stock popped on news its Covid-19 vaccine works as a booster.

- Why Lowe's stock dropped, despite its earnings beat.

Gold Prices Extend Winning Streak as Bitcoin Plummets

Oil prices closed at their lowest level in over three weeks on Wednesday. Weighing down the commodity was new Energy Information Administration (EIA) data, which showed an increase in U.S. crude inventories. Plus, traders are concerned Russia may lift sanctions on Iran. In response, June-dated crude fell $2.13, or 3.3%, to settle at $63.36 per barrel.

Gold prices logged their fifth-straight win, on the other hand, as well as a fresh four-month high. The yellow metal got a boost as bitcoin and traditional stocks declined. As a result, June-dated gold rose $13.50 cents, or 0.7%, to settle at $1,881.30 an ounce.