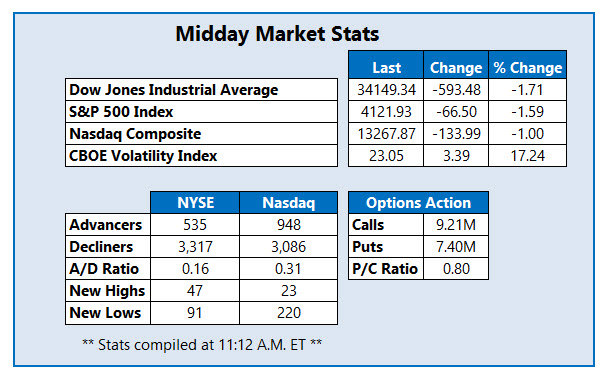

The Dow is down nearly 600 points midday

The Dow Jones Industrial Average (DJI) is sliding even deeper into the red this afternoon, last seen off over 590 points. The Big-Tech selloff has begun to cast its shadow over other sectors, including the energy space, which propped up the blue-chip index for the better part of yesterday's session. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also suffering nasty pullbacks of their own, as the aforementioned tech slide shows no signs of slowing.

Tesla (TSLA), in particular, is weighing on the space following an announcement that the company paused its plans to create an export hub in its Shanghai plant. Inflation fears also continue to plague Wall Street, keeping plenty of weight on "growth stocks" as well.

Continue reading for more on today's market, including:

- More on L Brands stock ahead of its big spinoff.

- Breaking down Roblox's mixed earnings debut.

- Plus, option bears gear up for HD earnings; 3D Systems stock topples key trendline; and secondary stock offering slams AEI.

Home Depot Inc (NYSE:HD) is seeing puts pop during today's trading, with 17,000 across the tape so far, triple the intraday average and almost double the number of calls exchanged. The May 340 put is the most popular, followed by the weekly 5/14 325-strike put, with new positions being opened at both. HD is off 3.2% at $33.46 at last check, with investors eyeing the company's first-quarter earnings release, due out before the open next Tuesday, May 18. The security hit an all-time high of $345.69 during yesterday's trading.

A first-quarter earnings beat has helped make 3D Systems Corporation (NYSE:DDD) one of the best performing stocks on the New York Stock Exchange (NYSE) today. The 3D printer maker reported first-quarter profits of 17 cents per share on $146.1 million in revenue, handily topping analysts' estimates. The security was last seen up 21.5% at $21.62, toppling pressure at its 20-day moving average, which contained rallies since a mid-February bear gap.

Alset Ehome International Inc (NASDAQ:AEI) is one of the worst performing stocks on the Nasdaq, off 36.9% to trade at $4.00 at last check. This comes after the company priced its public offering of 4.7 million shares of common stock at $5.07 per share. The construction stock is trading at record lows as a result, and is now down 62% for the month.