The Nasdaq sank deeper into the red this afternoon

The Dow tumbled from an intraday record today, erasing most of its gains in the last hour of trading to finish 34 points lower, despite a shift to reopening plays and energy stocks earlier in the session. The S&P 500 also closed with a modest loss, falling just short of Friday's record high, while the Nasdaq sank deeper into the red as traders dumped tech en masse.

Elsewhere, Wall Street is monitoring the aftermath of this weekend's cyberattack, which led to the Colonial Pipeline shutdown. Traders are also keeping an eye on rebounding transportation stocks, which can often serve as an indicator of global economic activity.

Continue reading for more on today's market, including:

- BOX moved higher after an investor shakeup.

- This restaurant stock typically surges post-earnings.

- Plus, analyst upgrades venue operator; unpacking Marriot stock's revenue miss; and how to take advantage of earnings season.

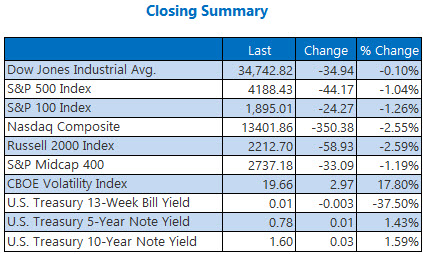

The Dow Jones Industrial Average (DJI - 34,742.82) shed 34.9 points, or 0.1% for the day. 3M (MMM) led the Dow components with a 4.3% rise, while Intel (INTC) paced the laggards, falling 2.9%.

Meanwhile, the S&P 500 Index (SPX - 4,188.43) fell 44.2 points, or 1% for the day. The Nasdaq Composite (IXIC - 13,401.86) shaved 350.4 points, or 2.6% for the day.

Lastly, the Cboe Volatility Index (VIX - 19.66) added nearly 3 points, or 17.8% for the day.

- The World Health Organization (WHO) reclassified the triple-mutant Covid-19 variant in India as a global health threat, adding it has the potential to evade vaccines. (CNBC)

- Fresh data from the Bureau of Labor Statistics showed grocery prices have risen during the pandemic, jumping between 3% and 5% from the same point just a year earlier. (MarketWatch)

- Options bulls blasted this venue operator after a lofty bull note.

- Marriot stock dipped following a first-quarter revenue miss.

- There is still time to take advantage of earnings season.

Gold Nabs Four-Straight as U.S. Dollar Plummets

Oil prices were slightly higher on Monday, after a ransomware attack shut down some of the largest refineries in the U.S., which provide the East Coast with about 45% of its fuel. Investors are expecting the country to slow down refining activities, and boost gasoline imports. As a result, June-dated crude added two cents, or 0.02%, to settle $64.92 per barrel.

Meanwhile, gold prices notched their fourth-straight win, as well as their best level since February. The yellow metal surged amid a drop in the U.S. dollar to a more than two-year low, as well as weakness in the broader market. In response, June-dated gold added $6.30, or 0.3%, to settle at $1,837.60 an ounce.