The Dow is clinging to shallow gains midday

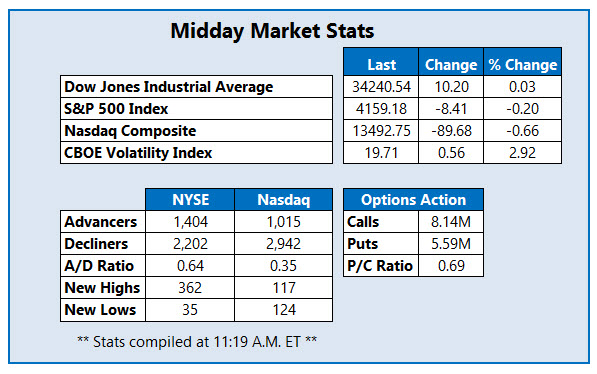

The Dow Jones Industrial Average (DJI) is clinging to muted gains during Thursday's session, last seen up 10 points, and fresh off a record high, as investors tap the breaks following yesterday's wild rally. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC), meanwhile, are eyeing shallow losses, even after this morning's jobless claims data bested expectations. Both indexes are pacing for weekly losses, while the latter is looking to notch its fifth-straight daily drop, marking its longest losing streak since October. Wall Street is looking ahead to even more employment numbers, with April's jobs report due out on Friday. Economists are expecting 978,000 jobs to have been added last month, and forecast an unemployment drop to 5.8%.

Continue reading for more on today's market, including:

- The beer brewing stock buzzing after CEO departure.

- Breaking down the mixed analyst sentiment surrounding UBER post-earnings.

- Plus, JMIA brushes off Citron optimism; MITO surges on fresh data release; and earnings miss mutes YELL.

This afternoon, there is an unusual amount of bullish options activity surrounding Jumia Technologies AG (NYSE:JMIA). The German e-commerce company is expected to report earnings before the open next Tuesday, May 11. Citron chimed in before the event, saying JMIA has become a better buy than ever. Despite this, JMIA is down 0.4% to trade at $25.99 and earlier hit a five-month low of $24.03. The stock is off 36% this year, pressured lower in recent months by its 20-day moving average. Bulls are brushing off this negative price action, and so far 32,000 calls have crossed the tape -- three times the intraday average. Most popular is the weekly 5/7 24-strike call, followed by the 27-strike call in the same series, with positions being opened at both.

Stealth BioTherapeutics (NASDAQ:MITO) just presented a round of fresh data from a Phase 1 ReCLAIM study for its elamipretide treatment in patients with non-central geographic atrophy (GA) and high risk drusen associated with dry age-related macular degeneration (AMD). Its stock is one of the best performers on the Nasdaq in response, up 86.7% at $2.24 at last check, toppling its 30-day moving average for the first time in over a month.

Freight logistics name Yellow Corp (NASDAQ:YELL), meanwhile, is one of the worst performers on the Nasdaq. The stock is down 32.3% at $6.47 after the company posted first-quarter losses of $1.26 per share, which came in much wider than the 64 cent per share loss expected by analysts. Its revenue did top estimates, though the company said severe weather, especially in the southern U.S., significantly impacted results. The shares are headed for their lowest close since early March, breaching their formerly supportive 50-day moving average.