The Dow finished the day up 227 points

The Dow closed 227 points higher today, as the broader market swiftly brushed off yesterday's concerns regarding Biden's tax plan, while the S&P 500 Index and Nasdaq finished firmly in the black as well. Bank and tech stocks gave the market a boost, however, today's rally wasn't enough to cover the week's entire deficit, with all three benchmarks notching modest weekly losses.

Meanwhile, investors had plenty of economic data to unpack as well. According to new home sales data for March, new homes were bought at their fastest pace since 2006, at a seasonally-adjusted annual rate of 1.021 million. Furthermore, the IHS Market U.S. composite purchasing managers index rose to 62.2 in April -- a record high.

Continue reading for more on today's market, including:

- Marijuana stocks making moves this past week.

- Analyst upgrades airline concern on risk/reward profile.

- Plus, Spotify stock surges; analysts blast INTC with bear notes; and SNAP jumps on revenue beat.

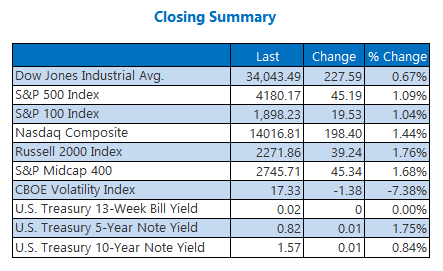

The Dow Jones Industrial Average (DJI - 34,043.49) rose 227.6 points, or 0.7% for the day, shedding 0.5% for the week. Goldman Sachs (GS) topped the list of blue chips with a modest 2.6% gain, while Intel (INTC) landed at the bottom after dropping 5.3%.

The S&P 500 Index (SPX - 4,180.17) added 45.2 points, or 1.1% for the day, dipping 0.1% for the week. Meanwhile, the Nasdaq Composite (IXIC - 14,016.81) gained 198.4 points or 1.4% for the day, and lost 0.2% for the week.

Lastly, the Cboe Volatility Index (VIX - 17.33) lost 1.4 points, or 7.4% for the day, and 6.6% for the week.

- A Turkish cryptocurrency exchange has temporarily closed, but many are worried their funds have been stolen as its CEO has reportedly gone missing. (CNBC)

- Copper posted its highest finish in over nine years. Here's a look into what drove these prices higher. (Marketwatch)

- Fresh coverage sends music streaming stock higher.

- The semiconductor name slipping on profit expectations.

- Social media giant rebounds from a losing streak.

Oil, Gold Finish the Week Lower

Oil prices gained for a second day, after economic data gave energy demand sentiment a boost. June-dated crude added 71 cents, or 1.2%, to settle at $62.14 a barrel for the day, however, prices still lost 1.6% for the week.

Gold futures ended lower for the second-straight day, after the rise in bond yields. June-dated gold fell $4.20, or 0.2%, to settle at $1,777.80 an ounce. For the week, gold prices finished down around 0.1%.