Dow futures are eyeing a triple-digit drop

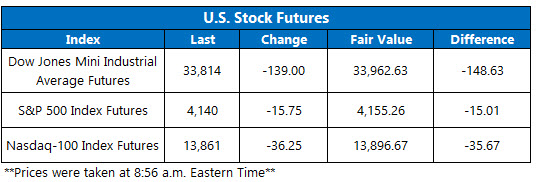

Stock futures are pointed lower this morning, set to extend yesterday's losses after the major benchmarks succumbed to a bout of profit-taking. Dow Jones Industrial Average (DJI) futures are staring at a 139-point drop. Similarly, futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are eyeing a modest move into the red as well, with Big Tech poised to struggle once more. On the flipside, the first-quarter earnings season has been an upbeat one so far, with financials beating estimates by 38%, while S&P 500 results are up 12%, according to Credit Suisse.

Continue reading for more on today's market, including:

- Schaeffer's Senior V.P. of Research Todd Salamone warns of long-term technical patterns.

- Netflix stock has been flat ahead of today's quarterly report.

- Plus, Lockheed Martin stock dips on revenue miss; tobacco stock plummets on nicotine reduction rumors; and Procter & Gamble posts top-line beat.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.6 million call contracts traded on Monday, and 750,046 put contracts. The single-session equity put/call ratio rose to 0.45 and the 21-day moving average stayed at 0.46.

- Lockheed Martin Corporation (NYSE:LMT) is down 1.2% before the bell, after the defense giant posting better-than-expected quarterly results, but revenue that fell short of expectations. Additionally, the company lifted its full-year forecast for metrics such as sales and cash from operations. LMT is up 10% in 2021 heading into today.

- Cigarette concern British American Tobacco PLC (NYSE:BTI) is down 3.1% ahead of the open. The negative price action came after the Wall Street Journal reported the White House could demand nicotine levels be cut in all cigarettes.

- The shares of Procter & Gamble Co (NYSE:PG) are down 0.5% in electronic trading, despite the consumer products icon posting a quarterly earnings and revenue beat. Procter & Gamble attributed the strong results to continued demand for cleaning products, and added it will raise prices for a number of products in September.

- The Case-Shiller home price index and consumer confidence index are slated for release today.

European Markets Lower as Investors Monitor Earnings

Stocks in Asia were mixed in today's session. The South Korean Kospi led the winners with a 0.7% pop, while Hong Kong's Hang Seng trailed behind with a 0.1% gain. Elsewhere, China's Shanghai Composite dipped 0.1%, after news released that the country kept the one-year loan prime rate and five-year LPR at 3.85% and 4.65%, respectively. Lastly, Japan's Nikkei fell 2%, amid rising Covid-19 cases.

In Europe, shares are struggling for upside today, as investors keep an eye on earnings. London's FTSE 100 is down 1.1% at last check, as the tobacco sector struggles given potential U.S. nicotine restrictions by the Biden administration. Meanwhile, the French CAC 40 is down 1.5%, and the German DAX has lost 0.9%.