The Nasdaq ended the day with triple-digit gains

The Dow closed 68 points lower today, as blue-chip stock Johnson & Johnson's (JNJ) vaccine distribution pause weighed on sentiment, with six reported cases of blood clots in patients post-inoculation. On the flip side, the S&P 500 rose to a new record close, while the Nasdaq finished the day with triple-digit gains. Investors have been unpacking higher-than-anticipated inflation data, after the consumer price index (CPI) rose 0.6% from last month and 2.6% year-over-year -- its highest in two and a half years. According to the Federal Reserve, the uptick is likely temporary, which would help the Fed's current plan to keep monetary policy the same.

Continue reading for more on today's market, including:

- 3M stock labeled a "catalyst call" sell ahead of earnings.

- Options bears target SCHW as it slips from recent highs.

- Plus, CL's recent earnings history; BMY receives a bull note; and the travel name trading near highs.

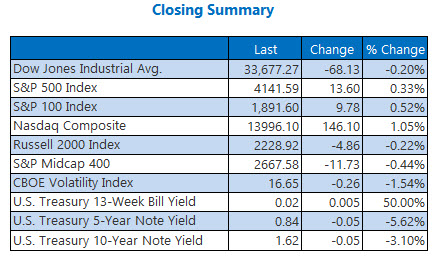

The Dow Jones Industrial Average (DJI - 33,677.27) fell 68.1 points today, or 0.2% for the day. Apple (AAPL) topped the list of blue chips, adding 2.4%, while IBM (IBM) dropped to the bottom after shedding 2.5%.

Meanwhile, the S&P 500 Index (SPX - 4,141.59) added 13.6 points, or 0.3%, for the day, and the Nasdaq Composite (IXIC - 13,996.10) gained 146.1 points, or 1.1%.

Lastly, the Cboe Volatility Index (VIX - 16.65) lost 0.3 point, or 1.5%, for the day.

- Gas tax is not being considered as part of U.S. President Joe Biden's infrastructure plan. The subject came up in yesterday's meeting with congress, where Biden gave his reasoning. (CNBC)

- Used-car prices are soaring. Here is some insight into why that may be. (MarketWatch)

- Colgate-Palmolive stock has struggled so far this year.

- The biopharma seeing recent technical support.

- BKNG upgraded on global travel expectations.

Gold, Oil Gain on Fresh Economic Updates

Oil futures closed higher for a second day, after a strong 2021 forecast for oil demand from the Organization of the Petroleum Exporting Countries (OPEC). May-dated crude rose 48 cents, or 0.8%, to settle at $60.18 a barrel.

Gold futures rose today after the higher-than-expected inflation data. June-dated gold closed up $14.90, or 0.9%, to settle at $1,747.60 an ounce.