All three benchmarks enjoyed weekly wins

The Dow enjoyed triple-digit gains today, securing a new record close and finishing the week with a win. The other major benchmarks also ended the week firmly in the black, with the S&P 500 climbing to its third-straight record close, while the Nasdaq finished today's session with a solid win after a last-minute surge. Inflation concerns nipped at the market's gains today, after data showing the producer price index (PPI) rising a higher-than-expected 1% in March, as well as hitting its largest annual gain in nine years. In response, the 10-year Treasury yield, which has been a major market mover in recent weeks, rose slightly.

Continue reading for more on today's market, including:

- Cigarette name trading near recent highs after analyst upgrade.

- OKTA was upgraded after yesterday's analyst meeting.

- Plus, the sports gambling stock making moves; HON hit with bull notes; and a look at AMRS' rally out of penny-stock territory.

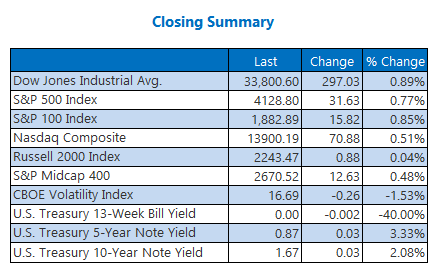

The Dow Jones Industrial Average (DJI - 33,800.60) added 297 points today, or 0.9% for the day, and 2% for the week. Honeywell (HON) topped the list of blue chips with a 3.2% pop, while Walgreen Boots Alliance (WBA) sunk to the bottom after shedding 1.1%.

Meanwhile, the S&P 500 Index (SPX - 4,128.80) gained 31.6 points, or 0.8%, for the day, and 2.7% for the week. The Nasdaq Composite (IXIC - 13,900.19) tacked on 70.9 points, or 0.5%, for the day, and 3.1% for the week.

Lastly, the Cboe Volatility Index (VIX - 16.69) lost 0.3 point, or 1.5%, today, and 3.7% for the week.

- Tensions have flared in Northern Ireland in recent months. Political leaders held video meetings today in order to try to find a solution. (MarketWatch)

- U.S. President Joe Biden created a bipartisan commission to study potential reforms to the Supreme Court. See what changes could be made and why. (Reuters)

- DraftKings' market cap is worth monitoring amid its recent pullback.

- HON opened at fresh highs after J. P. Morgan Securities labeled it a "top pick."

- This biotech stock could benefit from a short squeeze.

Gold Finishes the Week Higher, Oil Extends Drop

Oil prices closed lower for the second-straight day, as global Covid-19 cases point towards a potential lack of demand, and supply still no shows no sign of diminishing after last week's OPEC+ decision. May-dated crude fell 28 cents, or 0.5%, to settle at $59.32 a barrel. Since its April 1 settlement, which marked the end of the holiday-shortened week, prices have lost 3.5%.

Gold futures fell today, following a six-week high, as rising bond yields weighed. June-dated gold dropped $13.40, or 0.8%, to settle at $1,744.80 an ounce. For the week, however, gold prices finished nearly 1% higher.