The Nasdaq enjoyed triple-digit gains on the back of big tech

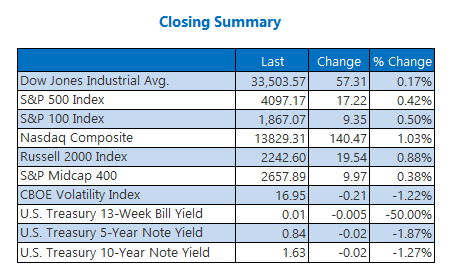

The Dow closed 57 points higher today, while the Nasdaq enjoyed triple-digit gains as big tech stocks rallied, and the S&P 500 notched another record close. Investors unpacked worse-than-expected jobs data for the second week running, with jobless claims for last week coming in at 744,000 -- higher than the anticipated 694,000. Meanwhile, U.S. mortgage rates fell for the first time in over a month, with the average 30-year loan reading dropping to 3.13% from 3.18% for the week prior -- driven by the steadily declining bond yields.

Continue reading for more on today's market, including:

- Disappointing guidance weighs on beverage giant.

- Analysts chime in on USB as it trades near annual high.

- Plus, a chip stock worth a closer look; CAG's earnings report; and the wellness name seeing analyst attention.

The Dow Jones Industrial Average (DJI - 33,503.57) added 57.3 points today, or 0.2%. Apple (AAPL) topped the list of blue chips with a 1.9% pop, while Nike (NKE) sunk to the bottom after shedding 2.1%.

Meanwhile, the S&P 500 Index (SPX - 4,097.17) gained 17.2 points, or 0.4%, and the Nasdaq Composite (IXIC - 13,829.31) tacked on 140.5 points, or 1% for the day.

Lastly, the Cboe Volatility Index (VIX - 16.95) lost 0.2 point, or 1.2%, today.

- The demand for luxury cars has showed no signs of slowing. See what company had its best quarter in its 116-year history. (CNBC)

- U.S. President Joe Biden has announced steps to tackle gun violence. One of the new measures includes cracking down on "ghost guns," which effectively turn pistols into rifles. (Reuters)

- The often-overlooked chip-maker with impressive gains.

- The food name slipping despite an upbeat earnings report.

- Plenty of pessimism surrounds this outperforming wellness stock.

Gold Logs Highest Close Since Late February

Oil prices closed lower today, as rising global Covid-19 cases hint at a potential lack of demand, and the U.S.-Iran nuclear deal remains stagnant. May-dated crude fell 17 cents, or 0.3%, to settle at $59.60 a barrel.

Gold futures scored a six-week high today, one day after snapping a four-session win streak. Prices were boosted after the Federal Open Market Committee (FOMC) minutes, which came out right after gold's close yesterday. June-dated gold climbed an impressive $16.60, or 1%, to settle at $1,758.20 an ounce.