The ISM services index jumped to a record 63.7% in March

Stocks started the week out strong, with the Dow and S&P 500 both nabbing fresh closing highs. The Nasdaq finished firmly in the black as well. Plenty of upbeat economic data boosted the market today, with nonfarm payrolls increasing by 916,000 in March, while the unemployment rate fell 6%. Bond yields also continued to ease, with the 10-year Treasury yield dropping after the ISM services index jumped to a record 63.7% in March -- pointing to recovery in restaurants and hotels. Finally, U.S. President Joe Biden's infrastructure plan was front and center, facing opposition from Republicans, while Treasury Secretary Janet Yellen called for a global minimum corporate tax to keep companies from relocating.

Continue reading for more on today's market, including:

- Pinterest stock extends its positive price action on VSCO buzz.

- Strong demand gives this electric vehicle giant a boost.

- Plus, airline stock takes flight; Planet fitness stock pops on expansion; and a look at VBTX's year-long rally.

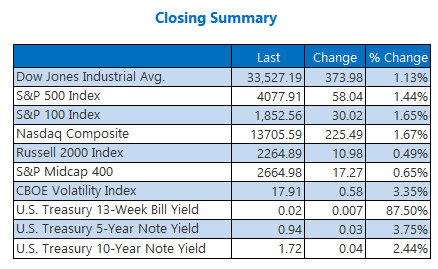

The Dow Jones Industrial Average (DJI - 33,527.19) added 374 points today, or 1.1%. Walgreens Boots Alliance (WBA) topped the list of blue chips with a 3.7% pop, while Goldman Sachs (GS) sunk to the bottom after shedding 1.3%.

Meanwhile, the S&P 500 Index (SPX - 4,077.91) gained over 58 points, or 1.4%, and the Nasdaq Composite (IXIC - 13,705.59) added 225.5 points, or 1.7% for the day.

Lastly, the Cboe Volatility Index (VIX - 17.91) added 0.6 points, or 3.4%, today.

- In a new report, UBS predicts far more closings ahead for U.S. retail stores. The analysts have gauged just how many stores will close by 2026, given rising e-commerce numbers and the country's retail space per capita. (CNBC)

- The U.S. is kicking up its production of the Covid-19 vaccine, last week averaging 3 million doses a day. Plus, Johnson & Johnson (JNJ) is taking over manufacturing at a Baltimore plant after a quality control mishap. (MarketWatch)

- Airline stock flies high on analyst upgrade.

- Planet Fitness stock rises on several company updates.

- The departure of a key board member has done little to slow VBTX.

There were no earnings of note today.

Oil Prices Fall on Supply Surplus

Oil prices dipped today, after several factors pointed to a potentially higher global supplies of oil, including last week's Organization of the Petroleum Exporting Countries and its allies (OPEC+) decision to increase production through July. May-dated crude fell $2.80, or 4.6%, to settle at $58.65 per barrel.

Following last week's moderate loss, gold prices rose today, though gains were pared by strength in the U.S. stock market. June-dated gold added 40 cents, or 0.02%, to settle at $1,728.80 an ounce.