The Dow added over 170 points on Thursday

Stocks finished the week out on a high note, with the S&P 500 toppling the 4,000 level for the first time ever, before eventually settling comfortably above the benchmark. The Dow and Nasdaq followed suit, as the former logged a triple-digit pop and the latter got a boost from Big Tech's strong rebound. All three indexes logged weekly wins as well.

President Joe Biden's infrastructure spending plan was in focus today, and investors appear to be reacting favorably, though some concern over the plan's proposed tax hikes is rumbling through Wall Street. There was plenty of data to unpack today, too, while traders brushed off worse-than-expected weekly jobless claims, to focus on a massive jump in U.S. manufacturing activity to 64.7 -- its highest level in 38 years. U.S. markets will be closed tomorrow in observance of Good Friday and the Easter weekend.

Continue reading for more on today's market, including:

- What happens to stocks when optimism runs rampant in an outperforming market.

- Unpacking Pfizer's latest vaccine update, and why its stock could still struggle.

- Plus, what sparked OKTA's selloff; TSM's chip-shortage solution; and the acquisition news sinking KMX,

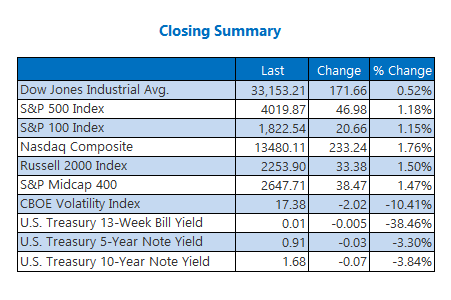

The Dow Jones Industrial Average (DJI - 33,153.21) added 171.7 points today, or 0.5%, with a weekly win of 0.1%. Salesforce.Com (CRM) topped the list of blue chips with a 3.2% pop, while UnitedHealth (UNH) sunk to the bottom after shedding 1.3%.

Meanwhile, the S&P 500 Index (SPX - 4,019.87) gained nearly 47 points, or 1.2% for the day, and added 1.1% for the week. The Nasdaq Composite (IXIC - 13,480.11) added 233.2 points, or 1.8% for the day, and 1.8% for the week.

Lastly, the Cboe Volatility Index (VIX - 17.38) fell 2 points, or 10.4%, today, with a weekly loss of 8.1%.

- Despite his reluctance to do so, pressure from members of the Democratic party as well as borrowers and advocates have driven President Joe Biden to ask Education Secretary Miguel Cardona to create a memo regarding his legal authority to cancel up to $50,000 in student loan debt. (CNBC)

- Many Black executives are urging corporations to go against Republican-led legislation that they believe could limit access to the polls in numerous states, specifically for Black voters. (MarketWatch)

- Why did Okta stock sell off last month?

- What one company is doing to ease the recent semiconductor-shortage.

- A marginal earnings beat and an acquisition update did little to help help CarMax stock.

Gold Tries to Dig Itself Out of First-Quarter Ditch

Oil prices rallied on a decision from Organization of the Petroleum Exporting Countries and their allies (OPEC+) to incrementally increase production starting in May and continuing up until July. May-dated crude added $2.29, or 3.9%, to settle at $61.45 per barrel, for the day, and 0.8% for the week.

Gold prices, meanwhile, logged their second-straight win, as the precious metal attempts to recover from its biggest quarterly loss since 2016. The softening of bond yields and lower-than-expected jobless claims were to thank for the price-pop. June-dated gold added $12.80, or 0.8%, to settle at $1,728.40 an ounce, though it lost 0.2% for the week.