The Dow gave back modest gains in the final half hour of trading

A resurgent tech sector was the big story on the last day of the month and quarter. Investor focus shifted to U.S. President Joe Biden's massive "Build Back Better" infrastructure plan, which will reportedly cost more than $2 trillion and be funded by a 28% corporate tax rate hike.

The Dow gave back modest gains to finish the day in the red, while the S&P 500 notched a modest win. Meanwhile, the tech-heavy Nasdaq logged its best day in nearly three weeks thanks to outsized gains from the likes of Tesla (TSLA) and FAANG names. It was the Nasdaq's fifth-straight monthly win and fourth-straight quarterly win.

Continue reading for more on today's market, including:

- Harley-Davidson stock is due for even more upgrades.

- Things could keep getting better for Big Lots stock.

- Plus, a Paychex earnings preview; bulls blast CHWY; and Bernstein eyeing AMAT.

The Dow Jones Industrial Average (DJI - 32,981.55) fell 85.4 points today, or 0.3% for the day, but rose 6.6% on the month, and 7.8% this quarter. Walgreen Boots Alliance (WBA) topped the list of Dow winners with a 3.6% rise, while The Travelers (TRV) paced the list of laggards with a 2.4% fall.

Meanwhile, the S&P 500 Index (SPX - 3,972.89) gained 14.3 points, or 0.4% for the day, 4.2% for the month, and 5.6% this quarter. The Nasdaq Composite (IXIC - 13,246.87) added 201.5 points, or 1.5% for the day, 0.5% this month, and 2.8% this quarter.

Lastly, the Cboe Volatility Index (VIX - 19.40) fell 0.2 point, or 1.1%, today, 30.6% on the month, and 14.7% for the quarter.

- In an effort to restore integrity and trust, Environmental Protection Agency Administrator Michael Regan will dismiss two advisory committee members that were picked by former President Donald Trump. (CNBC)

- Google is stepping up in the battle against "fake news," contributing $29 million to the new European Media and Information Fund. (MarketWatch)

- With earnings ahead, it's time to take a look at Paychex stock.

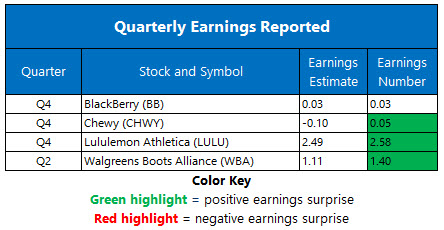

- Bulls blasted Chewy stock after an earnings beat.

- This Apple supplier hit a record high after Bernstein initiated coverage.

Gold Pacing for Biggest Quarterly Decline in Over 4 Years

Oil prices fell once again on Thursday, after the Organization of the Petroleum Exporting Countries and their allies (OPEC+) lowered their demand growth forecast for the year. The move sparked fears about the market's recovery, but some pressure was alleviated by upbeat factor activities data out of China. In response, May-dated crude shed $1.39, or 2.3%, to settle at $59.16 per barrel, for the day, while falling 3.8% this month. On the quarter, black gold added 22.5%.

Gold prices, meanwhile, walked away with a win, helped by a softening U.S. dollar. Still, the rising bond yield situation has the yellow metal on track for its biggest quarterly decline in over four years. April-dated gold added $29.90, or 1.4%, to settle at $1,713.80 an ounce, and a modest 0.01% this month. For the quarter, bullion shed 10%.