A dovish Fed noted Interest rates won't change until 2023

After a rocky start, stocks closed out the day with a win, after the U.S. Federal Reserve indicated there would be no interest rate hikes until at least 2023. The central bank also assured it will let inflation run more than usual in order to guarantee economic recovery. Fed Chair Jerome Powell, in the post-meeting press conference, noted that it would take a sustained move from inflation rates above 2% to alter the current dovish policy stance.

In turn, the Dow and S&P 500 scored their eighth win in nine trading days, adding a record close today, to boot. The tech-heavy Nasdaq also locked in a strong session for its third-straight gain. For investors monitoring rising bond yields, the 10-year Treasury eased from its high of the day and year after jumping to 1.689%.

Continue reading for more on today's market, including:

- Options bulls aren't sweating Plug Power stock's latest pullback.

- PYPL sets sights on record highs despite recent dip.

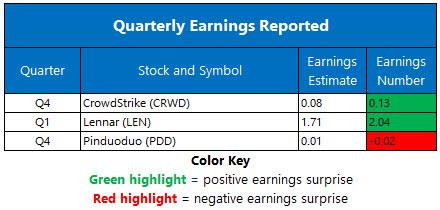

- Plus, one recovering energy stock; more on CRWD's post-earnings pop; and Micron makes headlines amid a potentially huge sale.

The Dow Jones Industrial Average (DJI - 33,015.37) rose 189.4 points, or 0.6% for the day. Dow Inc (DOW) led the blue chip components with a 4.5% rise, while Walgreen Boots Alliance (WBA) paced the laggards, falling 1.1%.

Meanwhile, the S&P 500 Index (SPX - 3,974.12) gained 11.4 points, or 0.3% for the day. The Nasdaq Composite (IXIC - 13,525.20) added 53.6 points, or 0.4% for the day.

Lastly, the Cboe Volatility Index (VIX - 19.23) fell 0.6 point, or 2.8% for the day.

- The Internal Revenue Service (IRS) pushed back the deadline for tax filing by one month, giving taxpayers in the U.S. more time to get tax affairs in order. (CNBC)

- With U.S. President Joe Biden's Covid-19 relief package now law, he's moving on to his infrastructure plan -- and it's going to be costly. (MarketWatch)

- FirstEnergy stock is on a hot streak as the company recovers.

- Call traders blasted Crowdstrike stock after earnings.

- A potentially massive sale has Micron stock moving higher.

Gold Surges to Intraday High After Fed's Policy Decision

Oil prices logged their fourth-consecutive loss as fears over weaker demand in Europe and rising inventories in the U.S. negatively impacted investor sentiment. The former worries stem from the pausing of AstraZeneca's vaccine due to possible side effects, and other countries in the region see increasing virus cases. As a result, May-dated crude fell 20 cents, or 0.4%, to settle at $64.63 per barrel.

Gold prices rose today, soaring to their highest levels on the day following the Fed's latest policy decision. In response, April-dated gold added $3, or 1.1%, to settle at $1,727.10 an ounce.