A better-than-expected jobs report boosted investor sentiment

After a tumultuous session, stocks surged in wild fashion as rising bond yields pulled back slightly. Tailwinds also came from a better-than-expected jobs report, which gave investors hope that the economic reopening would be faster than previously thought. As a result, the Dow jumped 572 points, after trading 150 points lower earlier in the day. The S&P 500 and Nasdaq both finished the session higher as well, although the latter turned in a weekly loss and remains negative on the year. All three benchmarks snapped three-day losing streaks. Elsewhere, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), snapped its three-day win streak.

Continue reading for more on today's market, including:

- These four cannabis stocks made headlines this week.

- Will Starbucks stock continue to buck the broader-market's plunge?

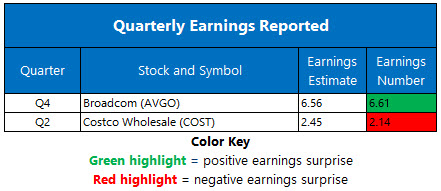

- Plus, AVGO getting analyst attention; bears ravaged Costco stock; and the computer company Goldman Sachs loves.

The Dow Jones Industrial Average (DJI - 31,496.30) rose 572.2 points, or 1.9% for the day, and 1.8% for the week. Chevron (CVX) topped the short list of winners, rising 0.8%, while Intel (INTC) fell to the bottom of the blue-chip after losing 2.6%.

Meanwhile, the S&P 500 Index (SPX - 3,841.94) added 73.5 points, or 2% for the day. The Nasdaq Composite (IXIC - 12,920.15) gained 196.7 points, or 1.6% for the day. The indexes gained 0.8% and lost 2.1%, respectively, for the week.

Lastly, the Cboe Volatility Index (VIX - 24.66) fell 3.9 points, or 13.7%, for the day and 12% for the week.

- According to the Centers for Disease Control and Prevention (CDC), easing mask mandates and reopening restaurants saw Covid-19 cases and deaths rise. (CNBC)

- Mark Brown, former Secretary of Education Betsy DeVos' appointee who oversaw the government's student-loan portfolio, has resigned. (MarketWatch)

- Broadcom stock received a lot of attention after earnings.

- See why bear notes poured in for Costco stock today.

- Goldman Sachs upgraded this computer company to "buy."

Oil Surges to Highest Level in Over a Year

Oil prices surged to their highest levels in over a year on Friday, after the Organization of the Petroleum Exporting Countries and its allies (OPEC+) pledged to not increase supply in April. The organization instead plans to wait for demand to rebound more as economic recovery efforts strengthen. As a result, April-dated crude added $2.26, or 3.5%, to settle at $66.09 per barrel on the day, and over 7% for the week.

Gold prices closed the week lower, holding near nine-month lows for a third-consecutive weekly loss as rising U.S Treasury yields and a strengthening dollar put pressure on the precious metal. In response, April-dated gold shed $2.20, or 0.1%, to settle at $1,698.50 an ounce on the day, and 1.8% for the week.