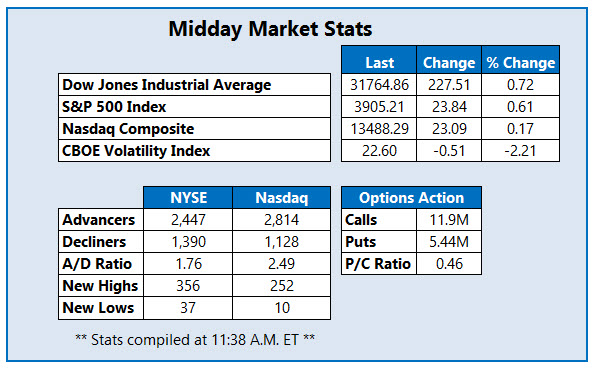

The Dow has added roughly 227 points at midday

Stocks are attempting to overcome this week's carnage at midday, as both the Dow Jones Industrial Average (DJI) and the S&P 500 Index (SPX) claw their way back into the black. The former is now up over 227 points, buoyed by big gains from several blue-chip bellwethers, including Boeing (BA) and Caterpillar (CAT).The Nasdaq Composite (IXIC) has also turned positive, as investors set aside anxieties around rising bond yields, which cast a long shadow over Big Tech.

A vaccine update from Johnson & Johnson (JNJ) is certainly contributing to some of this optimism. Earlier today, the U.S. Food and Drug Administration (FDA) deemed its single-dose Covid-19 vaccine both safe and effective, clearing the path to approval.

Continue reading for more on today's market, including:

- How Square stock is faring after jumping on the Bitcoin bandwagon.

- GameStop holds onto the spotlight after CFO resignation.

- Plus, SNAP hits new high after upbeat multi-year forecast; SYPR surges on DoD deal; and underwritten public offering sinks BCTX.

Snap Inc (NYSE:SNAP) is seeing a surge in options-related activity today, specifically on the call side. So far, 191,000 calls have been been exchanged -- double the intraday average, and nearly triple the 64,000 puts traded. The most popular is the weekly 2/26 73-strike call, followed by the 75-strike call in the same series, with new positions being opened at both. SNAP is up 0.4% at $70.71 at last check, but earlier hit an all-time high of $73.59, after the social media name forecast multiple years of 50% revenue growth. The announcement sparked price-target hikes from 17 analysts, including one to $95 from Pivotal Research.

One of the best performers on the Nasdaq today is Sypris Solutions, Inc (NASDAQ:SYPR). The stock was last seen up 91.7% at $5.10, nearly doubling on news that the company received a follow-on award from an U.S. Department of Defense (DoD) prime contractor. Sypris Solutions will be tasked with the manufacturing and testing of electronic power supply modules, starting this year. The security earlier hit a 13-year high of $7.89, just one day after it breached long-term support at the 20-day moving average. The stock has surged back above this level today, and sports a 244.7% year-to-date lead.

One of the worst performing stocks on the Nasdaq today is Briacell Therapeutics Corp (NASDAQ:BCTX). The equity was last seen down 38.1% to trade at $3.69, after the firm announced the underwritten public offering of more than five million U.S. units, at a price of $4.25 per unit, amounting to roughly $25 million. The security is trading dangerously close to its Oct. 12, all-time low of $3.25. Longer term, BCTX has lost 78.1% over the past 12 months.