The Dow is down roughly 77 points at midday

Growing anxiety over higher interest rates has pushed many on Wall Street to take profits on February's impressive rally. The tech sector in particular is taking a big hit, causing the Nasdaq Composite (IXIC) to drop below the technically significant 50-day moving average for the first time since November. The Dow Jones Industrial Average (DJI) isn't faring much better, down roughly 77 points at midday, while the S&P 500 Index (SPX) is eyeing its sixth-straight daily loss.

Fed Chair Jerome Powell's comments before Congress did little to assuage investor anxiety. The central bank leader called inflation "soft," adding that the "economy is a long way from our employment and inflation goals," indicating that the Fed will likely hold the monetary policy steady. Powell did not address, however, the recent growth in bond yields.

Continue reading for more on today's market, including:

- Analysts brush off PANW's post-earnings plummet.

- Unpacking this television's stock drop after a quarterly win.

- Plus, option bulls eye VZ despite technical trouble; retail trading frenzy claims CTIB; and CCIV sinks on billion-dollar merger.

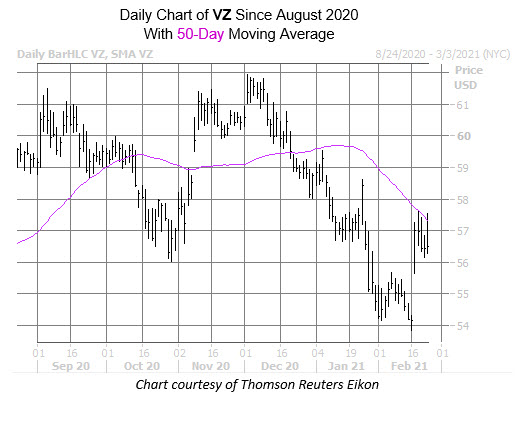

Verizon Communications Inc. (NYSE:VZ) is seeing a surge in bullish options activity today. So far, 47,000 calls have crossed the tape -- nearly double what is typically seen at this point -- compared to just over 7,000 puts. The most popular is the March 57 call, where positions are being bought-to-open. The second most popular is the weekly 2/26 57-strike call, which expires by the end of the week. The security was last seen up 0.7% to trade at $56.85, clawing back higher after some of this morning's gains were stifled by recent pressure at the 50-day moving average. Year-to-date, VZ is down roughly 3.7%.

The best performing stock on the Nasdaq today is packaging producer Yunhong CTI Ltd (NASDAQ:CTIB). The security is up nearly 84% to trade at $4.34 at last check. And while there isn't a concrete reason for the rally, some are speculating CTIB could be the latest target of a trading frenzy sparked by Reddit's Wall Street Bets, in an effort to cause a short squeeze. Earlier today, the security hit an eight-month high of $5, and now sports a year-to-date lead of 127.9%.

A proposed merger with Lucid Motor is making Churchill Capital Corp IV (NYSE:CCIV) one of the worst performing stock on the New York Stock Exchange (NYSE) today. The equity is down 32.2% at $38.75 after announcing the $11.75 billion deal, which will take Lucid Motors -- an electric vehicle company backed by an ex-Tesla engineer -- public. The drop has also knocked CCIV off its Feb. 18, all-time high of $64.86, though the equity still sports an impressive 304.6% year-to-date gain.