Treasury Secretary Janet Yellen called for further stimulus last night

Markets are on the rise on Friday, looking to end this somewhat lackluster week on a high note, after comments from Treasury Secretary Janet Yellen pushed for a heftier stimulus bill. The Dow Jones Industrial Average (DJI) has added roughly 148 points at the midway mark, while both the S&P 500 Index (SPX) and the Nasdaq Composite (IXIC) are also registering solid gains. The semiconductor sector, in particular, is getting a boost after Applied Materials (AMAT) posted a better-than-expected earnings report.

Continue reading for more on today's market, including:

- How TRIP traveled to annual highs, even after an earnings miss.

- The streaming stock hitting pause after its quarterly report.

- Plus, UAL attracts option bulls on flight news; VCNX doubles on multi-project deals; and GTEC cools from record peak.

United Airlines Holdings Inc (NASDAQ:UAL) is seeing an uptick in bullish options activity today, with over 82,000 calls exchanged so far. This is three times the intraday average, and over five times the number of puts exchanged. The most popular is the June 50 call, followed by the weekly 2/26 50-strike call, with positions being opened at both. UAL is up 7.3% at $48.24 at last check, after announcing plans to commence daily nonstop service between Boston Logan and London Heathrow airports. The security is also eyeing its first close atop its 320-day moving average since January 2020, though it's still down 40% year-over-year.

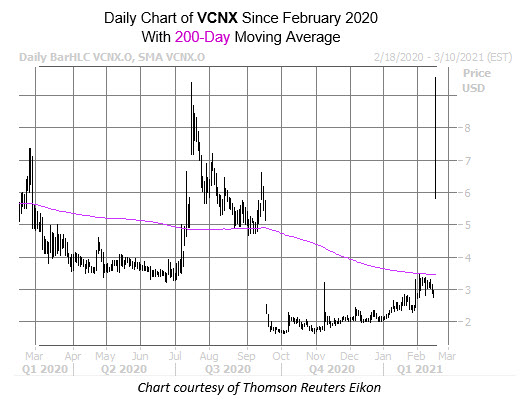

Vaccinex Inc (NASDAQ:VCNX) is one of the best performing stocks on the Nasdaq today, last seen up 116.4% at $6.21, following the signing of multi-project deals with two unnamed pharmaceutical companies. The deals focus on Vaccinex's ActivMAb antibody discovery and novel viral display platform. The equity earlier hit an annual high of $9.56 and toppled its 200-day moving average, which has kept a lid on shares since their late-September plummet.

Greenland Technologies Holding Corp (NASDAQ:GTEC) is one of the worst performing stocks on the Nasdaq today, cooling from yesterday's massive surge to an all-time high of $26.42, which happened after the company signed an agreement with Fujian South China Heavy Machinery Manufacture (SOCMA). While the stock is down 16.6% to trade at $12.30 at last check, it's still up 70.9% this year, and pacing for its second-highest close ever.