The U.S. economy added 49,000 jobs in January

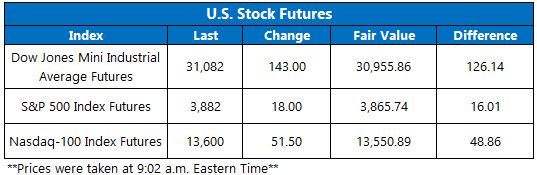

Stock futures are on the rise once again this morning, with the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) coming off of four-straight wins while Nasdaq-100 Index (NDX) futures look to extend its record close. Should these gains hold, all three benchmarks would be looking at their best week since November. Investors are so far brushing off a lackluster jobs report from last month, which saw the U.S. economy add 49,000 jobs in January -- slightly below Wall Street estimates -- while the unemployment rate came in at a better-than-expected 6.3%.

Continue reading for more on today's market, including:

- Tenet Healthcare stock is flashing a bull signal on the charts.

- A broadcasting stock for options bulls.

- Plus, JNJ seeks FDA approval; PINS and EL jump higher after earnings.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 2.2 million call contracts traded on Thursday, and 910,641 put contracts. The single-session equity put/call ratio fell to 0.41 and the 21-day moving average stayed at 0.41.

-

Johnson & Johnson (NYSE:JNJ) is up 1.9% before the bell today, after news that the blue-chip drugmaker submitted its coronavirus vaccine to the Food and Drug Administration (FDA) for emergency use. Climbing upward once again after cooling off from its Jan. 26 all-time highs, JNJ is up 15.9% in the last three months.

- The shares of Pinterest Inc (NASDAQ:PINS) are up 9.7% in electronic trading, after the social media name reported better-than-expected fourth-quarter earnings and revenue. To follow, no fewer than nine analysts raised their price targets, including J.P. Morgan Securities to $102. If these gains hold, PINS is looking to extend yesterday's record high.

- Estee Lauder Companies Inc (NYSE:EL) is up 5.5% ahead of the open, after the company's fourth-quarter earnings and revenue beat estimates on strong demand in China. To follow, Oppenheimer raised its price target to $300 from $265.

- Today will bring average hourly earnings, trade deficit, and consumer credit data.

Overseas Markets Join In on Gains

Asian markets were mostly higher to wrap up the week, with the Japanese Nikkei surging 1.5%, after reports that Apple (AAPL) is in talks with multiple companies to work on the autonomous electric vehicle it plans to develop with Hyundai-Kia. The South Korean Kospi was still getting a boost from the potential partnership, too, and added 1.1%. Elsewhere, Hong Kong’s Hang Seng rose 0.6% thanks to Kuaishou Technology’s blowout debut, while China’s Shanghai Composite fell 0.2%.

European stocks are higher as well, with investor sentiment getting a boost from gains stateside and earnings. In other news, Johnson & Johnson (JNJ) said it will apply for emergency use of its single-dose Covid-19 vaccine in Europe within the next few weeks, while the continent’s drug regulator is already analyzing data for antibody treatments from Eli Lilly (LLY) and Regeneron (REGN). In turn, the France CAC 40 was last seen up 1%, while the German DAX is 0.2% higher, and London’s FTSE 100 is slightly below breakeven, down 0.08%.