The Nasdaq gave back modest gains to close slightly below breakeven, though

Stocks managed to pivot higher after a muted Wednesday afternoon, as investors celebrated better-than-expected jobs data and sifted through earnings from Big Tech giants Amazon.com (AMZN) and Alphabet (GOOGL). Both the S&P 500 and Dow scored a third consecutive win, with the latter reversing earlier losses to tack on about 36 points. Meanwhile, the Nasdaq finished the day slightly below breakeven. Against this backdrop, Wall Street's "fear gauge," the Cboe Market Volatility Index (VIX), logged its third-straight loss.

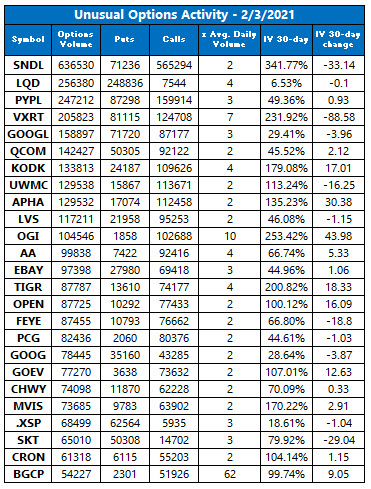

Elsewhere, traders are keeping an eye on stimulus negotiations in Washington, D.C. while looking ahead to corporate reports from the likes of Qualcomm (QCOM), eBay (EBAY) and Yum China (YUM) after the close.

Continue reading for more on today's market, including:

- The e-tail giant that surpassed $100 billion in sales.

- Options bears hungry for Chipotle stock after earnings miss.

- Plus, online dating stock gets the cold shoulder; a refresher on Coca-Cola stock; and the Schaeffer's 2021 stock pick with short-covering potential.

The Dow Jones Industrial Average (DJI - 30,723.60) rose 36.1 points, or 0.1% on the day. Boeing (BA) led the Dow components with a 3.2% rise, while Amgen (AMGN) paced the laggards, falling 1.4%.

Meanwhile, the S&P 500 Index (SPX - 3,830.17) added 3.9 points, or 0.1% for the day. The Nasdaq Composite (IXIC - 13,610.54) was down 2.2 points, or 0.02% for the day.

Lastly, the Cboe Volatility Index (VIX - 22.91) lost 2.7 points, or 10.4% for the day.

- Centers for Disease Control and Prevention (CDC) Director Rochelle Walensky said schools can safely reopen before teachers receive a Covid-19 vaccine. (CNBC)

- Twitter (TWTR) banned MyPillow CEO Mike Lindell's corporate account after he used it to spread claims that Donald Trump won the 2020 election. (MarketWatch)

- Online dating stock gets the cold treatment after lukewarm earnings.

- Refresh on Coca-Cola stock ahead of next week's quarterly report.

- The Schaeffer's 2021 stock pick with major short-covering potential.

Oil Rises to Annual High After OPEC Committee Meeting

Oil prices rose to an annual high on Wednesday, after news broke that the Organization of the Petroleum Exporting Countries (OPEC) left its output policy unchanged following a monthly committee meeting. Hopes for additional stimulus and a 1 million barrel drop in U.S. crude inventories also gave the commodity a boost. In turn, March-dated crude added 97 cents, or 1.7%, to settle at $55.73 per barrel.

Gold prices also moved higher, with the yellow metal recovering some of the losses it suffered alongside silver as a result of a Reddit-fueled trading frenzy, which was later capped by the CME Group. In response, April-dated gold jumped $1.70, or 0.1%, to settle at $1,835.10 an ounce.