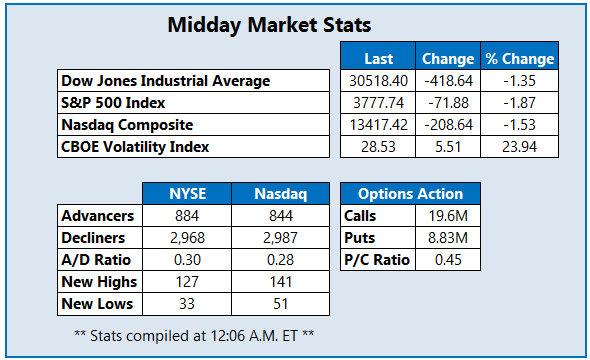

The Dow was down over 400 points at midday

Stocks are deepening their losses at midday, as investors become increasingly worried about a considerable amount of speculative trading, as well as dismal earnings reports from giants such as blue-chip Boeing (BA). The Dow Jones Industrial Average (DJI) was last seen down roughly 418 points, while the tech-heavy Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are registering significant losses as well. Later today, traders will be sifting through comments from Fed Chairman Jerome Powell, who will offer an update on the country's economic outlook. Meanwhile, Wall Street's "fear gauge" -- the CBOE Volatility Index (VIX) -- is pacing for its biggest jump since June.

Continue reading for more on today's market, including:

- The coffee chain attracting bullish attention after its fiscal first-quarter report.

- Texas Instruments stock's earnings beat reels in the bull notes.

- Plus, new collaboration heats up SIRI's options pits; Express stock another target of speculative trading; and a look at one China stock's U.S. debut.

One stock seeing notable options activity today is Sirius XM Holdings Inc (NASDAQ:SIRI), last seen up 7% to trade at $7.01, after earlier hitting a 16-year high of $8.14. The pop came after company announced a the launch of new original programs with comedy brand Laugh Out Loud, including the debut of podcast "Inside Jokes with Kevin Hart." So far, 69,000 calls and over 11,000 puts have crossed the tape, which is eight times the intraday average. Most popular is the monthly February 6.50 call, followed by the weekly 2/5 7-strike call, with new positions currently being opened at the latter. The stock had been struggling with overhead pressure at the $6.80 mark for much of the past year, since dropping to a March 23, three-year low of $4.11. In the last three months, SIRI has added 22.7%.

Surging on the New York Stock Exchange (NYSE) today is Express, Inc. (NYSE:EXPR), up 183.2% at $8.61 at last check, and earlier touched a four-year high of $13.97. Earlier this month, the retailer announced a deal to add $140 million in financing, but now it seems to be engulfed in similar Reddit speculations that propped up videogame concern GameStop (GME), among others. The equity had been on a steady decline down the charts over the past year, culminating in a Nov. 11 all-time low of 57 cents. In the last three months alone, though, EXPR has tacked on 1,208.5%.

Near the bottom of the Nasdaq today is China-based e-bike maker EZGO Technologies Ltd (NASDAQ:EZGO), last seen down 52% to trade at $8.69, cooling off after nearly quadrupling during its U.S. debut yesterday. EZGO debuted on the Nasdaq after pricing an $11.2 million initial public offering (IPO) of 2.8 million common shares, at $4 per share. The security is still well above its IPO price, though yesterday's high of $19.44 is still very much out of reach.