The Dow was down triple-digits at midday

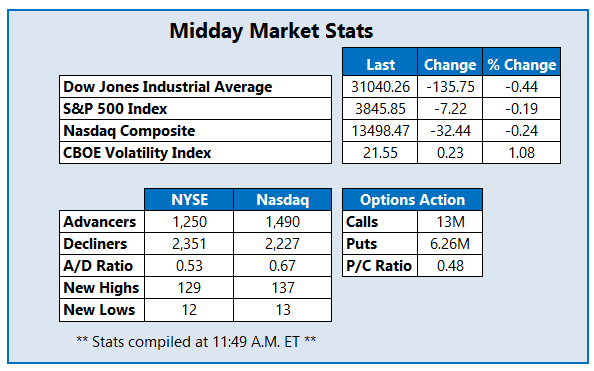

Stocks are pulling back from record levels on Friday afternoon, as investors became less optimistic about President Joe Biden's coronavirus rescue plan, which is drawing criticism from both sides of the aisle in Congress. The Dow Jones Industrial Average (DJI) was last seen down 135 points, led lower by outsized post-earnings losses from IBM (IBM) and Intel (INTC). Meanwhile, both the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are registering substantial losses as well. Nonetheless, all three major benchmarks remain on track for weekly wins.

Continue reading for more on today's market, including:

- How Wall Street is reacting to IBM's revenue miss.

- Another blue-chip stock swimming in red ink, despite analyst praise.

- Plus, options bears circle STX after Q2 report; Chinese stock surges closer to IPO price; and GSL tumbles after stock offering.

One stock seeing notable options activity today is Seagate Technology PLC (NASDAQ:STX), last seen down 6.9% to trade at $58.57, despite the company reporting better-than-expected fiscal second-quarter earnings results. What is hurting the stock is a decline in gross margins, which dipped to 26.8% from 28.7% the previous year. So far, 13,000 puts and over 11,000 calls have already crossed the tape, which is five times the intraday average. Most popular by far is the 1/22 60-strike put, followed by the 58-strike put in the same weekly series, with new positions currently being opened at the latter. Buyers of these options expect to see more downside for Seagate Technology stock by the end of the day, when contracts expire. The equity is cooling off from a Dec. 17, six-year high of $66.69, though the 60-day moving average seems have come in as a floor. In the last six months, STX is up 22%.

Near the top of the New York Stock Exchange (NYSE) today is iHuman Inc (NYSE:IH), up 8.2% at $22.60 at last check, though a reason for the positive price action was not immediately clear. The China-based educational software company began trading publically in early October, with an initial public offering (IPO) price of $12 per share. Shares had been cooling off from a Nov. 24 all-time high of $31.58 over the last few weeks, but today's pop helped the equity break through overhead pressure at the newly emerged 60-day moving average. Year-to-date, IH sports a 25.2% lead.

Near the bottom of the NYSE today is Global Ship Lease Inc (NYSE:GSL), last seen down 12.4% to trade at $13.05. The bear gap came after the company sold 5.4 million shares of its common stock at $13 per share -- a 12.8% discount to last night's close -- raising $70.2 million to fund the expansion of its containership fleet. The security has been climbing up the charts since its March 19 all-time low of $2.66, culminating in a Jan 15, four-year high of $17.69. Meanwhile, the stock's ascending 30-day moving average seems poised to contain today's pullback, and GSL has added 213.8% in the last nine months alone.