The Dow is boasting a triple-digit pop at midday

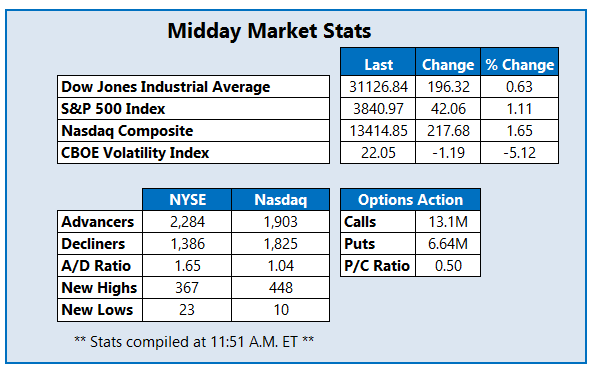

All eyes are on the inauguration of Joe Biden, who was sworn in as the 46th president of the United States this afternoon. Wall Street is responding to the transition with optimism, while a number of upbeat earnings reports are also contributing to the cheerful sentiment. The Dow Jones Industrial Average (DJI) is up over 195 points at midday, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) scored fresh intraday highs earlier in the session, with the latter getting a significant boost from streaming giant Netflix (NFLX).

Continue reading for more on today's market, including:

- PACCAR stock rose after striking a self-driving truck deal with Amazon-backed Aurora.

- Fresh analyst coverage helped this tech stock bounce back.

- Plus, MPC's options pits heat up; Chinese stock breaks through recent resistance; and Equitrans stock keeps chopping lower.

One stock seeing notable options activity today is Marathon Petroleum Corp (NYSE:MPC), down 1.4% to trade at $45.46, amid news that the Environmental Protection Agency (EPA) granted three waivers to oil refiners, which will leave them exempt from biofuel blending obligations. The move -- a last-minute mandate under the Trump administration -- has prompted disapproval from ethanol and biodiesel producers.

MPC's options pits are bullish, though, with 57,000 calls across the tape so far, which is seven times the intraday average. Most popular is the April 50 call, followed by the 45 call in the same monthly series, with positions being opened at the former. The security has been chopping higher since dropping to a March 19, 10-year low of $15.26, with a recent leg of support emerging at its 40-day moving average. In the last nine months, MPC has added 84.6%.

Near the top of the New York Stock Exchange (NYSE) today is KE Holdings Inc (NYSE:BEKE), up 12.2% at $71.13 at last check, though a catalyst for the positive price action was not immediately clear. The Chinese real estate company began trading publicly in August, with an initial public offering (IPO) price of $20 per share. Prior to today's pop, shares had been cooling off from a Nov. 16 record high of $79.40, and struggling with overhead pressure at the $68 mark. Year-to-date, BEKE sports a roughly 14% lead.

Near the bottom of the NYSE today is Equitrans Midstream Corp (NYSE:ETRN), last seen down 8.9% to trade at $6.97, after the natural gas company announced the early tender results of cash tender offers, for up to $500 million in aggregate principal amount of senior notes. The stock has seen a volatile run on the charts over the past year, dropping to a March 19, all-time low of $3.75. And while shares rallied above the $11 level in August, the stock has been chopping lower ever since, with today's bear gap only reinforcing long-term resistance from the 120-day moving average. Longer term, ETRN carries a 43.9% year-over-year deficit.