All three major benchmarks are flat at midday

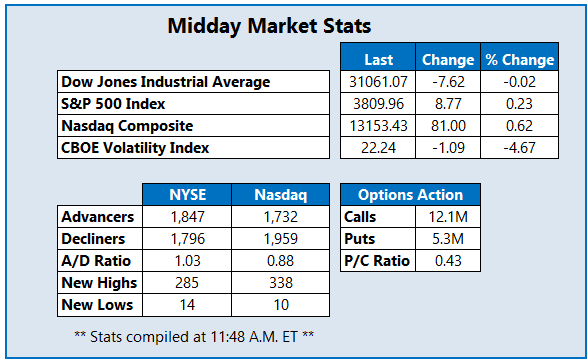

Stocks are trading on both sides of the aisle this afternoon, as investors digest yet another spike in Covid-19 cases, higher interest rates, and political tension. Also in focus is the latest round of inflation data, which was in line with Wall Street's expectations. As a result, the Dow Jones Industrial Average (DJI) was last seen trading just below breakeven, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are both trading modestly higher.

Elsewhere, Vice President Mike Pence said he would not invoke the 25th Amendment to remove President Donald Trump from office, and the House of Representatives will vote to impeach the president once more later today. Meanwhile, Johns Hopkins University data showed the U.S. is registering more than 240,000 coronavirus infections a day.

Continue reading for more on today's market, including:

- American Tower stock slips following billion-dollar deal.

- GOOGL rises after suspending Trump's YouTube channel.

- Plus, Intel appoints new CEO; videogame stock surges on investor deal; and Party City stock plummets on downbeat sales forecast.

One stock seeing notable options activity today is Intel Corporation (NASDAQ: INTC), last seen up 7.9% to trade at $57.45, after the tech concern appointed VMware's (VMW) Pat Gelsinger as its new CEO. In response, the security earned a price-target hike from Evercore to $68 from $55. So far, 343,000 calls 141,000 puts have already crossed the tape, which is four times the intraday average. Most popular by far is the January 2021 60-strike call, followed by the 65-strike call in the same series, with positions being opened at the latter. The security has had a rough run on the charts since its late-July bear gap, but today's pop helped it break through overhead pressure at the 200-day moving average, which has rejected several rally attempts since October. Year-over-year, INTC is down 3.3%.

Near the top of the New York Stock Exchange (NYSE) today is videogame concern GameStop Corp. (NYSE:GME), up 70.8% at $34.08 at last check, after hitting a five-year high of $38.65. The impressive bull gap came after the company signed a deal with investor Ryan Cohen's RC Ventures LLC, and appointed the Chewy.com (CHWY) co-founder as well as other two e-commerce experts to its board. The security started picking up steam in late August -- with support from the 40-day moving average -- after dropping to an April 3, all-time-low of $2.57. Year-over-year, GME is up an astounding 587.7%.

Near the bottom of the NYSE today is Party City Holdco Inc (NYSE:PRTY), last seen down 11.2% to trade at $7.17, after the company posted a dismal fourth-quarter sales forecast due to the rapid surge of COVID-19 cases. Shares had been steadily climbing up the charts since November to hit a Jan. 8, two-year high of $8.40, with support from the 20-day moving average. In the last nine months alone, PRTY added over 1,619%.