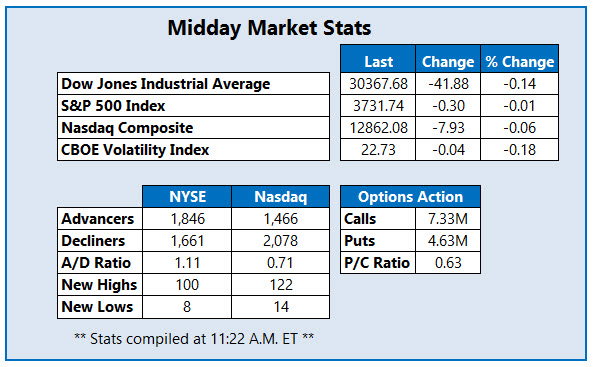

All three major indexes are eyeing shallow midday losses

Not much has changed in terms of market movement since this morning, with all three major indexes looking to end the New Year's Eve session on a relatively quiet note. The Dow Jones Industrial Average (DJI) is still roughly 40 points in the red, while the S&P 500 Index (SPX) continues to hover around breakeven. The Nasdaq Composite (IXIC), meanwhile, has traded in this morning's gains for shallow losses. All three indexes are expected to finish the month and the year with sizable wins, however. Quite the feat, considering the wild amount of volatility Wall Street saw for most of 2020.

Continue reading for more on today's market, including:

- The renewable energy stock joining the S&P 500 in January.

- What the latest bitcoin ETF attempt means for MicroStrategy stock.

- Plus, option players pick up BMY before the end of the year; HOTH surges on cancer drug agreement; and ENVB completes spin-off.

Bristol-Meyers Squibb Co (NYSE:BMY) is seeing an uptick in activity in its options pits today. So far, 19,000 calls and over 6,000 puts have crossed the tape -- double the intraday average. The February 62.50 call is seeing the most action, followed by the 60 put in the same monthly series, with positions being opened at both. BMY is down 1.1% at $61.24 at last check, and off 4.5% in 2020.

Hoth Therapeutics Inc (NASDAQ:HOTH) just inked a production agreement with Tergus Pharma for the production of its experimental cancer drug HT-001, which treats patients with skin disorders associated with certain cancer therapies. This news made HOTH one of the best performers on the Nasdaq today, last seen up 50.3% at $2.47. The security cleared several layers of long-term resistance as a result, including its 160- and 80-day moving averages. Despite this impressive surge, HOTH is looking to end 2020 in the red, with a 60.9% year-to-date deficit.

Enveric Biosciences, Inc. (NASDAQ:ENVB), formerly AMERI Holdings (AMRH), just completed its spin-off and tender offer, changing its name and ticker to begin trading under ENVB this morning. The shares, which saw a surge earlier this week, are one of the worst performers on the Nasdaq today, down 26.3% at $4.36 at last check, and looking at a 51.3% deficit for 2020.