All three major indexes scored intraday record highs earlier today

All three major benchmarks brushed off a disappointing November jobs report on Friday to score record closes, and modest weekly wins. The Dow added roughly 248 points, thanks to outsized gains from Chevron (CVX) and Caterpillar (CAT). Meanwhile, the S&P 500 got a nice boost from the energy sector, and the tech-heavy Nasdaq finished significantly higher.

Elsewhere, some investors are interpreting the worse-than-expected jobs data as added pressure to pass a second stimulus bill, with Senate Minority Leader Chuck Schumer tweeting that the report showed the need for "strong, urgent emergency relief." The calls for stimulus come amid new records in coronavirus infections, hospitalizations and single-day deaths.

Continue reading for more on today's market, including:

- A Jefferies bull note sent this auto e-tail stock higher.

- Marvell stock downgraded after quarterly revenue miss.

- Plus, Netflix stock drops despite bull note; watch this food delivery stock closely; and unpacking CRM's buyout.

The Dow Jones Industrial Average (DJI - 30,218.26) gained 248.7 points, or 0.8% on the day, and 1% on the week. Caterpillar (CAT) led the Dow components with a 4.3% rise, while Boeing (BA) paced the laggards, falling 1.9%.

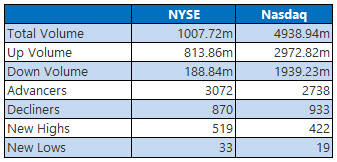

Meanwhile, the S&P 500 Index (SPX - 3,699.12) added 32.4 points, or 0.9%, for the day, and 1.6% on the week. The Nasdaq Composite (IXIC - 12,464.23) was up 87.1 points, or 0.7% for the day, and 2.1% on the week.

Lastly, the Cboe Volatility Index (VIX - 20.79) fell 0.5 point, or 2.3% for the day, and 0.2% on the week.

- World Health Organization (WHO) officials warned that new data suggests people who have recovered from COVID-19 can still get infected a second time. (CNBC)

- The House of Representatives passed a bill that could decriminalize marijuana at the federal level, but it lacks support in the Republican-run Senate. (MarketWatch)

- Netflix stock moves lower despite price-target hike.

- Keep tabs on this outperforming food delivery stock.

- Diving into Salesforce stock after its $27.7 billion Slack buyout.

Gold Prices Snap Three-Day Winning Streak

Oil prices rose again today to finish the week higher, after the Organization of the Petroleum Exporting Countries and its allies (OPEC+) increased collective production by 500,000 barrels each day, despite the agreement being less aggressive than some had hoped. As a result, January-dated crude added 62 cents, or 1.4%, to settle at $46.26 a barrel. For the week, it added 1.6%.

Meanwhile, gold prices were lower, snapping the three-day winning streak that helped the commodity score a gain for the week. While prices initially rose thanks to renewed stimulus talks in Congress and a weak November jobs report, vaccine developments ultimately offset gains. In turn, February-dated gold fell $1.10, or 0.1%, to settle at $1,840 an ounce for the day. For the week, it gained 2.9%.