Wall Street is building off of November's historic rally

Adding to its historic November rally, the Dow Jones Industrial Average (DJI) has tacked on 380 points at midday, with gains from Chevron (CVX) and UnitedHealth (UNH) leading the charge. The positive movement comes as investors await testimonies from Federal Reserve Chairman Jerome Powell and U.S. Treasury Secretary Steven Mnuchin, which they will give before congress. Meanwhile, the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also higher, and in fact hit all-time highs, after NBC News reported that Mnunchin and House Speaker Nancy Pelosi are set to speak. Elsewhere, a group of bipartisan lawmakers put forth a $908 billion stimulus plan.

Continue reading for more on today's market, including:

- Analysts are weighing in on this stay-at-home staple.

- Children's Place stock is eyeing a five-month high.

- Plus, which pharmaceutical stock is seeing a surge in calls; why BlackBerry stock is flying up the charts; and one energy stock that's plummeting.

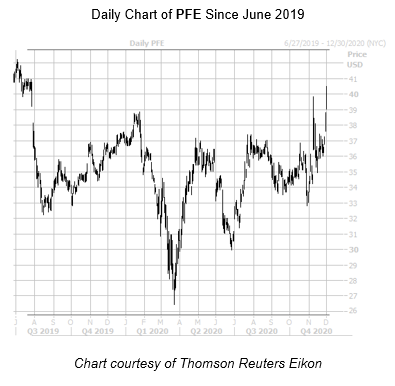

One stock seeing notable options activity today is Pfizer Inc. (NYSE:PFE). PFE has had an incredible time on the charts since taking a spot as one of the leads in the COVID-19 vaccine race, and is up 4% at $39.85 at last check -- its highest level in 2020. As a result, 386,000 calls have exchanged hands -- six times the intraday average and volume pacing in the highest percentile of its annual range. The most popular is the weekly 12/4 40-strike call, where new positions are being opened.

One stock surging on the New York Stock Exchange (NYSE) today is BlackBerry Ltd (NYSE:BB). BB was last seen up 52% to trade at $8.94, after the company teamed up with Amazon to develop and market an intelligent vehicle data platform. Today's rise has the equity trading at levels not seen since 2019. Now, year-to-date, BlackBerry stock is up 39%.

On the opposite end of the NYSE, Switchback Energy Acquisition Corp (NYSE:SBE) is down 10.7% to trade at $30.10. Though the reason for the plunge is unclear, the equity is now on pace to close at its lowest level in more than a week. Still, SBE has tacked on 94.9% quarter-to-date, and has support from its 10-day moving average.