The Dow was down over 300 points at its session lows earlier

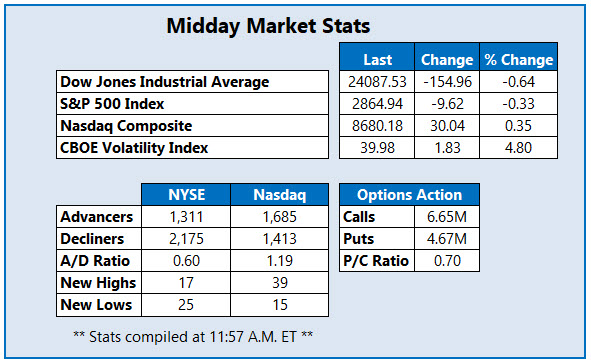

The Dow Jones Industrial Average (DJI) is firmly in the red to begin the week, down triple digits at midday amid sputtering oil prices. But while the blue-chip index has come off its sharper session lows from the morning, black gold is still careening around its lowest level in more than 20 years amid growing demand and storage concerns. At last check, May-dated crude futures --which expire on Tuesday -- were down 43.1% to trade at $10.36 per barrel, on track for their worst single-session decline of all time. The S&P 500 Index (SPX) is joining the Dow in the red, while the Nasdaq Composite (IXIC) is holding on to marginal gains thanks to an outperforming tech sector.

Continue reading for more on today's market, including:

- This casino stock is sliding amid re-opening drama.

- A $3.85 billion acquisition isn't enough to keep Pepsi stock afloat today.

- Plus, CrowdStrike calls pop; and two stocks soaring amid the stay-at-home orders.

One stock seeing notable options trading activity today is CrowdStrike Holdings Inc (NASDAQ:CRWD). The cybersecurity company was last seen trading up 6.4% at $68.86. At last check, over 27,000 CRWD calls have changed hands, seven times the average intraday amount and volume pacing for the 100th percentile of its annual range. The weekly 4/24 75-strike call is leading the charge, with nearly 11,000 calls being ordered up. The next closest is the June 100 call with new positions being opened at both. Currently, CRWD is up 37.9% in 2020.

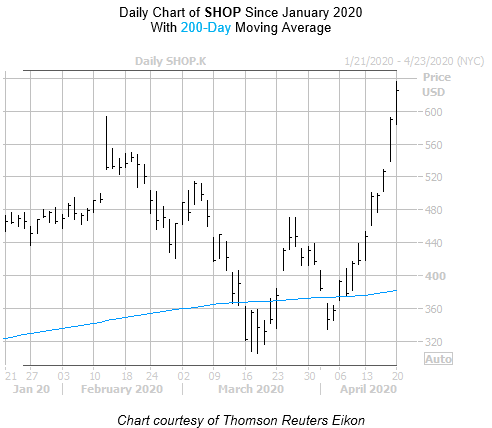

One stock continuing its hot streak is Shopify Inc (NYSE:SHOP), up 4.7% to trade at $619.36 at last check and on track for its fourth straight win. Shopify's CEO tweeted that the e-commerce company is handling "Black Friday level traffic" lately amid the stay-at-home orders. This is helping offset a price-target cut to $626 from Pi Financial. SHOP earlier hit a record high of $636, and is up 179% in the last 12 months.

Meanwhile, another "stay-at-home" stock soaring today is Netflix Inc (NASDAQ:NFLX), last seen up 3.7% to trade at $438.61 at last check. The FAANG stock is a chip-shot from its April 16 record high of $449.52, and is up 36.5% in 2020.