Major indexes are in the black as congress promises a quick decision

Expanding off its early morning surge, the Dow Jones Industrial Average (DJI) is up around 1,500 points midday, driven heavily by outperforming Boeing (BA), American Express (AXP), and Chevron (CVX). The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also making sizable gains, after yesterday falling to multiyear lows alongside the Dow. Market optimism is coming from hopes that congress is close to reaching an agreement on the stimulus bill. House Speaker Nancy Pelosi stated that there is hope a deal can be made within the next few hours.

Continue reading for more on today's market, including:

- Amazon takes measures to ensure fair pricing.

- The stock boosted by an earnings beat.

- Plus, TAL’s unusual options; the gaming name moving out of its slump; and the energy name surging.

One stock sporting unusual options volume today is Tal Education Group (NYSE:TAL), last seen 9.3% to trade at $51.41. So far the China-based school tutoring company has had 15,000 puts cross the tape so far, compared to only 103 calls -- or nine times the usual daily volume. Most popular is the April 37.50 put, where new positions are being opened. This surge in options comes from the coronavirus school closures, as online tutoring is much higher in demand.

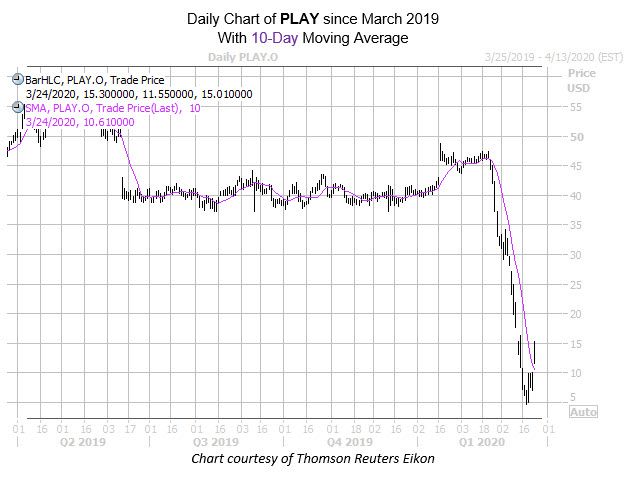

Topping the Nasdaq is Dave & Buster's Entertainment Inc (NASDAQ:PLAY), up 52.5% to trade at $15.19. This owner of entertainment and dining venues has been steadily creeping back up since hitting a record low of $4.60 on March 18, and just broke above the former resistance at its 10-day moving average.

Meanwhile, near the top of the New York Stock Exchange (NYSE) today is Bloom Energy Corp (NYSE:BE), last seen up $47.3% at $5.70, though the catalyst behind the surge is unclear. BE is climbing from a four-month bottom, but still sports a year-to-date deficit of 24%.