Macy's and BJs Wholesale stocks are lower after earnings

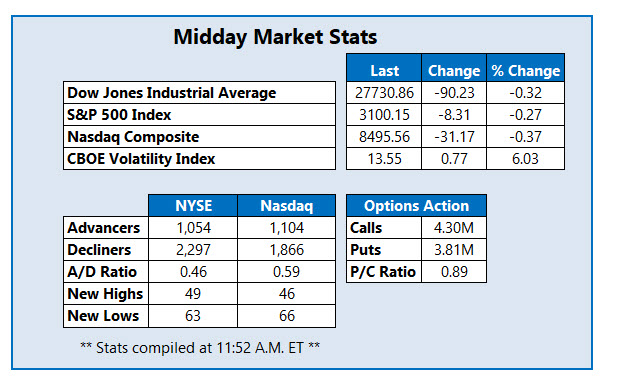

The U.S. stock market is lower at midday, as traders digest a new round of retail earnings, with Macy's (M) and BJs Wholesale Club (BJ) the latest to turn in disappointing results. Wall Street is also waiting on fresh U.S.-China trade updates -- with the latest reports indicating Beijing invited American negotiators to hold face-to-face talks -- and eyeing a larger-than-expected rise in weekly jobless claims. Against this backdrop, the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are pacing for a third straight loss, while the Nasdaq Composite (IXIC) is poised for back-to-back drops.

- The tech stock slapped with a new "sell" rating.

- Analysts rush to catch up with surging Target stock.

- Plus, Medtronic puts pop; L Brands sees a strong holiday season; and Seadrill slumps as chairman exits.

Medtronic (NYSE:MDT) is seeing unusual options volume today, after Deutsche Bank lifted its price target to $123 from $118. Options players are picking up puts, with 3,300 contracts across the tape so far -- roughly double the average intraday amount -- compared to 2,200 calls. The weekly 12/6 111-strike put is popular, and it looks these contracts being bought to open. MDT shares are down 1.9% at $110.42, testing their footing back atop the 10-day moving average.

Victoria's Secret parent L Brands Inc (NYSE:LB) is near the top of the New York Stock Exchange (NYSE) today, thanks to strong comparable sales at Bath & Body works in the third quarter, as well as an upbeat forecast for the holiday shopping season. At last check, LB stock is up 78% at $16.80, but remains 34% lower in 2019, under pressure from its 50-day moving average.

Seadrill Ltd (NYSE:SDRL) is near the bottom of the Big Board, down 23.4% at $0.93, a record low. This comes after the oil rig operator said Chairman John Fredriksen -- who is also SDRL's top stakeholder -- is stepping down, effective immediately, as the company meets with lenders to discuss restructuring debt.