The U.S. and China set a date for their next round of trade negotiations

Futures on the Dow Jones Industrial Average (DJI) are above fair value this morning, after the U.S. and China said they will hold two-day high-level trade negotiations beginning on Thursday, Oct. 11, in Washington. However, pre-market gains are modest, as traders digest an onslaught of economic reports, including a slimmer-than-expected rise in consumer spending in August, while durable goods unexpectedly rose last month thanks to Pentagon orders.

Elsewhere, oil prices are sinking, after Iranian President Hassan Rouhani said the U.S. offered to remove sanctions if the two countries sat down for negotiations. At last check, November-dated crude was down 2.1% at $55.21 per barrel.

Continue reading for more on today's market, including:

- Retail stock tapped as a "top pick" at Cowen.

- Bears blasted sinking Skyworks Solutions stock.

- 2 gold stocks squeezing shorts.

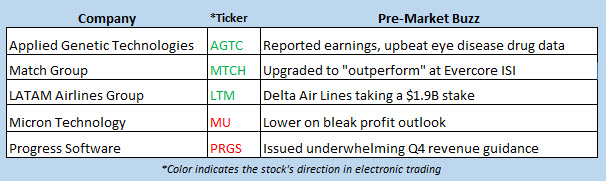

- Plus, Micron set for post-earnings slump; bluebird bio drops again; and the casino stock getting an S&P-related boost.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw 828,076 call contracts traded on Thursday, compared to 613,123 put contracts. The single-session equity put/call ratio jumped to 0.74, while the 21-day moving average remained at 0.64.

- Micron Technology, Inc. (NASDAQ:MU) reported fiscal fourth-quarter adjusted profit and revenue beats, but gave a weaker-than-aniticpated current-quarter profit forecast amid U.S.-China trade uncertainty. This has MU stock down 5.3% ahead of the bell, but analysts don't seem to mind, with several price-target hikes coming through this morning.

- The shares of bluebird bio Inc (NASDAQ:BLUE) are down 6% in electronic trading. It's been a terrible week on the charts for the gene therapies specialist, with BLUE stock down 10.3% through last night's close, and today, appears set to open just above its December lows.

- Las Vegas Sands Corp. (NYSE:LVS) stock is 5.1% higher in pre-market trading, on news the casino name will replace Nektar Therapeutics (NKTR) on the S&P 500 Index (SPX), prior to the open on Thursday, Oct. 3. LVS stock settled last night at $55.88, up 7.4% on the year.

- The University of Michigan consumer sentiment index, personal income, and the personal consumption expenditure (PCE) price index will hit today. Philadelphia Fed President Patrick Harker will speak. There are no quarterly reports of note, but Lennar (LEN) will be among those unveiling earnings next week.

Rate Cut Buzz Boosts London Stocks

Markets in Asia ended mostly lower on Friday. South Korea’s Kospi was the biggest loser, ending 1.2% lower. Hong Kong’s Hang Seng lost 0.3%, while Japan’s Nikkei slipped 0.8% lower, dampened by losses from Softbank Group, as well as Japan Display due to news that Chinese investment firm Harvest Group was withdrawing from a bailout. Meanwhile, China’s Shanghai Composite was up 0.1%, with traders digesting a 2% drop in industrial profits in the region for August.

European stocks are higher midday. The London FTSE 100 is up 1.1% after Bank of England Monetary Policy Committee (MPC) member Michael Saunders said another rate cut was “quite plausible,” putting the index on pace for its best close since early August. Elsewhere, the French CAC 40 has climbed 0.2% higher, while the German DAX has tacked on 0.9%.