Apple was the best Dow stock today

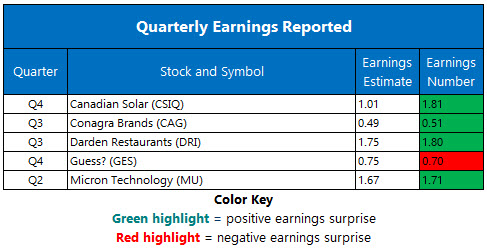

The Dow bounced back after Wednesday's Fed-inspired drubbing, surging more than 200 points as Apple (AAPL) stock extended its red-hot price action. Tech sector strength was underscored by a positive earnings reaction for Micron (MU), which helped boost blue-chip semiconductor stock Intel (INTC) nearly 2% higher on the day. Against this backdrop, the S&P 500 and Nasdaq sailed to big wins, as well, with all three major market indexes heading into Friday sporting strong week-to-date gains.

Continue reading for more on today's market, including:

The Dow Jones Industrial Average (DJI - 25,962.51) was down 87 points at its session low, before swinging to a 216.8-point, or 0.8%, gain. Apple (AAPL) outpaced 26 Dow advancers with its 3.7% gain, while JPMorgan Chase (JPM) led the four decliners with its 1.6% drop.

The S&P 500 Index (SPX - 2,854.88) tacked on 30.7 points, or 1.1%, while the Nasdaq Composite (IXIC - 7,838.96) added 109.9 points, or 1.4%.

The Cboe Volatility Index (VIX - 13.63) shed 0.3 point, or 2%.

5 Items on our Radar Today

- The Philadelphia Fed's six-month business outlook index for future activity slumped to a three-year low of 21.8 in March, pressured by lowered expectations for shipments and new orders. "Respondents continue to expect growth over the next six months, but most readings have been trending lower," the report noted. (Bloomberg)

- Facebook today confirmed that it stored 200 million to 600 million user passwords to the social media site in plain text, going back to 2012. The data was accessible to Facebook employees, though the company said in a blog post it had "found no evidence to date that anyone internally abused or improperly accessed them." (CNBC)

- Darden Restaurants stock cleared a key technical hurdle after earnings.

- Behind Biogen stock's plunge to new lows.

- Evercore set a lofty price target for PTE shares.

Data courtesy of Trade-Alert

Oil Dips Back Below $60 Per Barrel

Oil prices pulled back from yesterday's multi-month high, surrendering a short-term foothold above the key $60 per barrel mark. The new front-month May contract settled down 25 cents, or 0.4%, at $59.98 per barrel.

Gold gained today in reaction to a dovish Fed forecast. At the close, April-dated gold was up $5.60, or 0.4%, to settle at $1,307.30 an ounce.