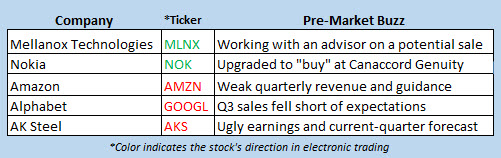

Shares of AMZN and GOOGL are down big before the open

It's setting up to be an ugly day on Wall Street, with Dow Jones Industrial Average (DJI) futures pointing to a more than 250-point sell-off. Likewise, the Nasdaq-100 Index (NDX) is also bracing for a triple-digit drop out of the gate. The latest round of corporate earnings has been thoroughly disappointing, headlined by sharp pre-market losses from FAANG members Amazon.com (AMZN) and Alphabet (GOOGL). Against this backdrop, traders are essentially shrugging off a stronger-than-expected third-quarter gross domestic product (GDP) update.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Chicago Board Options Exchange (CBOE) saw 1.18 million call contracts traded on Thursday, compared to 778,374 put contracts. The single-session equity put/call ratio moved down to 0.66, and the 21-day moving average held at 0.66

- Taking a closer look at FAANG earnings, AMZN shares are set to slump almost 7% at the open, due to the company's weaker-than-expected outlook for the holiday quarter. GOOGL, meanwhile, is off 5.4% in electronic trading, after the company posted a rare revenue miss for the third quarter.

- Joining those two in the losers' circle this morning is Snapchat parent Snap Inc (NYSE:SNAP), cratering 12.5% before the open. The move comes after the social media firm announced a second straight decline in users, and said it expects the trend to continue. This should put SNAP stock at a new all-time low.

- One name that was gaining after earnings was Chipotle Mexican Grill, Inc. (NYSE:CMG), after the company posted better-than-expected third-quarter results. CMG shares were signaling a 4% pop at the open, but could now be seeing headwinds from the broad-market weakness, last seen trading around breakeven.

- Data on consumer sentiment data also comes out today. Autoliv (ALV), Colgate-Palmolive (CL), and Goodyear Tire (GT) will wind down an active earnings week with their quarterly reports. Looking ahead, next week's schedule will have more earnings releases from FAANG members.

Stocks Everywhere Fall

It was a negative finish across the board in Asia today, with equity benchmarks ending lower after a choppy session. Despite Thursday's big rebound on Wall Street, investors abroad took their cues from steep after-hours earnings declines for U.S. tech giants. By the close, South Korea's Kospi's tumbled 1.8%, Hong Kong's Hang Seng shed 1.1%, Japan's Nikkei gave up 0.4%, and China's Shanghai Composite fell 0.2%.

European equity indexes are broadly lower at midday, following suit with the bearish tone set by Asia. In addition to negative earnings reactions from the likes of Amazon and Google, French auto parts name Valeo has tanked more than 20% after its quarterly results. At last check, France's CAC 40 is down nearly 2%, the German DAX is off 1.4%, and London's FTSE 100 has lost 1.1%.