The VIX closed the books on its worst weekly loss since April

U.S. stocks finished the day firmly positive in thin post-holiday trade. Better-than-expected jobs data pushed markets higher, despite the U.S. and China moving ahead with their first round of tariffs. The Dow and Nasdaq were up triple digits at their intraday highs, while the S&P also fared well, as all three indexes made their way to weekly wins. On the other hand, the VIX extended its drop, and suffered its steepest weekly loss since mid-April.

Continue reading for more on today's market, including:

- Penny stock Black Box popped on a social media partnership.

- One option bear bet on deeper losses for Ford stock.

- Plus, the oil stock ready to bounce; a buy signal for BZUN; and an analyst eyes record highs for Apple stock.

The Dow Jones Industrial Average (DJI - 24,456.48) finished up 99.7 points, or 0.4%. Walgreens (WBA) paced the 24 gainers with a 1.5% advance, while Caterpillar (CAT) took the biggest loss of 0.3%. For the week, the Dow added 0.8%.

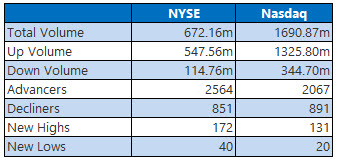

The S&P 500 Index (SPX - 2,759.82) settled 23.2 points, or 0.9%, higher. The Nasdaq Composite (IXIC - 7,688.39) ended up 101.9 points, or 1.3%. On a weekly basis, the SPX advanced 1.5%, while the Nasdaq rose 2.4%.

The Cboe Volatility Index (VIX - 13.37) shed 1.6 points, or 10.7%. The VIX gave up 16.9% on the week.

5 Items on Our Radar Today

- U.S. Secretary of State Mike Pompeo will begin his second day of talks with North Korea Saturday, in hopes to solidify a plan to move forward in denuclearizing the pariah state. The new round of meetings comes roughly one month after President Donald Trump and North Korean leader Kim Jong Un met in Singapore, which concluded with a vague agreement on the matter. (Bloomberg)

- Clothing subscription concern Stitch Fix (SFIX) ended the week with a massive two-day surge that added nearly half a billion dollars to its market cap. SFIX has gained more than 50% during the past month, thanks in part to Oprah buzz. (CNBC)

- Outperforming oil stock WLL is ready to bounce off a key trendline.

- This Baozun stock buy signal has never been wrong.

- Loop Capital upped its price target for Apple stock.

Data courtesy of Trade-Alert

Oil Futures Snap Two-Week Winning Streak

Oil closed modestly higher today, bouncing back from the previous session's inventory-related decline as equities rallied. August-dated crude finished up 86 cents, or 1.2%, at $73.80 per barrel for the day. For the week, oil dropped 0.5%.

Gold futures ended lower for the first day in three, as an upbeat jobs report supported the Fed's policy-tightening agenda. Gold for August delivery settled down $3, or 0.2%, at $1,255.80 per ounce for the day, but gained 0.1% for the week.