The Dow and S&P 500 secured their ninth straight monthly gains

The Dow Jones Industrial Average (DJIA) closed lower today, yet still finished 2017 on a high note by securing monthly and quarterly wins. For the year, the Dow tacked on 25% on its way to 71 record closes and its ninth straight month in the black -- the longest monthly winning streak in 60 years.

Both the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) also faltered in thin trading today. However, the S&P joined the Dow in notching its ninth straight monthly advance -- its lengthiest streak in over 30 years -- while the Nasdaq secured gains in every month but June, and brought its monthly winning streak to six.

Continue reading for more on today's market, including:

- The FAANG name that's "trickling up" executive pay post-tax plan.

- Buy the dip on this bitcoin stock.

- BorgWarner looks set for another hot start to the year.

- Plus, the best & worst stocks of the year; the catalyst that ended WATT's breakout rally; and a big finish for crude futures.

The Dow Jones Industrial Average (DJIA - 24,719.22) finished down 118.3 points, or 0.5%, led by a 1.1% drop in Apple (AAPL). The DJIA shed 0.1% for the week, but gained 1.8% for the month and 10.3% for the quarter.

Boeing (BA) was the biggest Dow gainer in 2017, adding 89.4%. On the other hand, General Electric (GE) was the biggest Dow decliner, shedding 44.8% over the course of the year.

The S&P 500 Index (SPX - 2,673.61) finished 13.9 points, or 0.5%, lower. The index lost 0.3% for the week, but gained 1% for the month and 6.2% for the quarter.

The Nasdaq Composite (IXIC - 6,903.39) lost 46.8 points, or 0.7%. It lost 0.8% for the week, but gained 0.4% for the month and 6.3% for the quarter. The S&P 500 gained 19.5% for the year, while the Nasdaq added an impressive 28.2%.

The CBOE Volatility Index (VIX - 11.04) added 8.4% for the day, and racked up weekly and quarterly gains of 11.5% and 16.1%, respectively. However, the VIX shed 2.1% for December, and ended 2017 down 21.4%.

5 Items on Our Radar Today

- This morning, the Trump administration followed through on its promise to rescind proposed Obama-era rules for hydraulic fracturing, or fracking, on government lands. The rules, which stipulated that companies must disclose the chemicals used in fracking, had previously been blocked by a federal judge in Wyoming in 2015. (USA Today)

- Cryptocurrency ripple, or XRP, soared to a record high north of $2.00 today. It briefly surpassed ethereum as the second-largest cryptocurrency by market capitalization. (CNBC)

- The best & worst stocks on Wall Street during the wild year of 2017.

- Understanding the 2 types of volatility.

- How a notorious short seller ended the two-day surge in WATT shares.

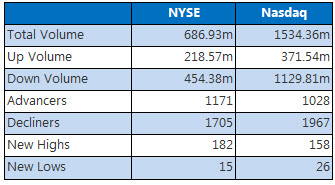

Data courtesy of Trade-Alert

Commodities

Crude futures for February delivery raced to the finish line this year, rising $0.58, or 1%, to close at $60.42 per barrel. On the heels of Thursday's decline in domestic stockpiles, traders today learned of a dip in U.S. rig counts. Oil ended the year up 12.5% after a 17% surge during the fourth quarter, and closed the year at its highest level since June 2015.

February-dated gold futures closed out the year strong, adding $12.10, or 0.9%, to settle at $1,309.30 an ounce -- the highest close since Sept. 25, and a seventh straight winning session. The safe-haven asset gained 2.5% in December, 2% in the fourth quarter, and 14% in 2017.