While the COMP touched yet another high, the DJIA is down on data and energy headwinds

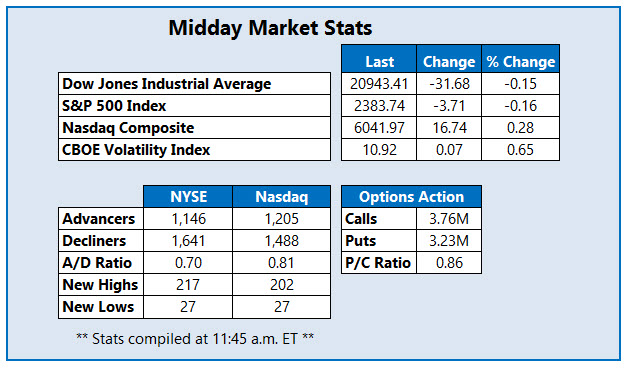

The Dow Jones Industrial Average (DJIA) was last seen modestly lower, even as the Nasdaq Composite (COMP) strung together its fourth straight day of record intraday highs. Stocks are reacting to a raft of weak economic data -- including a spike in weekly jobless claims and a drop in pending home sales -- as well as a mixed round of corporate earnings. Energy is also in view, as oil prices are flirting with one-month lows after production resumed at two Libyan oilfields. At last check, June-dated crude futures are down 2.5% at $48.40 per barrel. Looking ahead, traders are awaiting tomorrow's reading on first-quarter gross domestic product (GDP), and keeping an eye on Capitol Hill as lawmakers attempt to avert a government shutdown.

Continue reading for more on today's market -- and don't miss:

- 2 catalysts driving Paypal stock to record highs.

- How we tripled our money on this retail options trade.

- Plus, GrubHub gaps higher; the airline stock hitting turbulence; and Under Armour shares soar on earnings.

Among the names with unusual options volume today is GrubHub stock, with the contracts at 13 times the usual intraday rate. The shares have broken out to a 19% lead at $41.69, after the food firm had a strong showing in the earnings confessional. It seems options traders are banking on more volatility for GRUB stock in the next few months, with one speculator possibly initiating a long straddle at the June 42.50 strike.

One of the worst performers on the Nasdaq is American Airlines Group Inc (NASDAQ:AAL), down 7.3% to trade at $43.03. Proposed pay increases, deferred jet deliveries, and a bearish brokerage note are collectively pressuring the airline stock.

One of the New York Stock Exchange's best performers is Under Armor stock, up 8% at $21.29. Propelling shares of the athletic apparel maker are an upbeat earnings report and a bullish nod from Jefferies.