The Dow, SPX, and Nasdaq eked out wins at the close

The Dow Jones Industrial Average (DJIA) and S&P 500 Index (SPX) spent most of the day lower, as crude oil prices tanked for a second consecutive session. Meanwhile, traders reacted to the European Central Bank's (ECB) decision to stand pat on interest rates, even as the chances of a Fed rate hike next week grow. However, stocks caught an eleventh-hour tailwind ahead of tomorrow's highly anticipated nonfarm payrolls report, with the Dow and SPX both dodging a fourth straight loss.

Continue reading for more on today's market, including:

- 3 signs "Trump Optimism" has peaked.

- Time to buy options on these 3 Dow stocks.

- Our subscribers doubled their money on this aerospace options trade.

- Plus, a key Netflix trendline; one hard-hit retail stock; and iPhone 8 at risk.

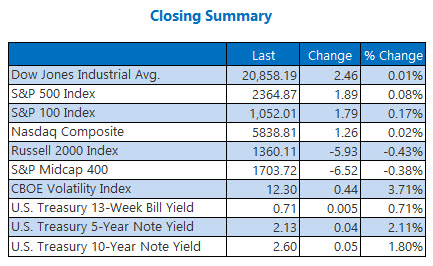

The Dow Jones Industrial Average (DJIA - 20,858.19) inched just 2.5 points higher, even though 21 of 30 components gained ground. The biggest advancer was Johnson & Johnson, adding 1.5%. Leading the nine decliners was Caterpillar stock, down 2%.

The S&P 500 Index (SPX - 2,364.87) tacked on 1.9 points, or almost 0.1%. It was a photo finish for the Nasdaq Composite (COMP - 5,838.81), which ultimately rose 1.3 points.

The CBOE Volatility Index (VIX - 12.30) jumped 0.4 point, or 3.7%, for its highest settlement since March 1.

5 Items on Our Radar Today

-

For the second time in two years, RadioShack is filing for

bankruptcy. In addition, the electronics retailer will shutter nearly 200 more stores.

(CNNMoney)

-

For the eighth time in 11 years, Alphabet was named

Fortune's

best company to work for. There were also five first-timers on the list, including Delta Air Lines.

(USA Today)

- A key trendline could send Netflix stock to record highs, if past is prologue.

-

- The Apple supplier jeopardizing the iPhone 8 launch.

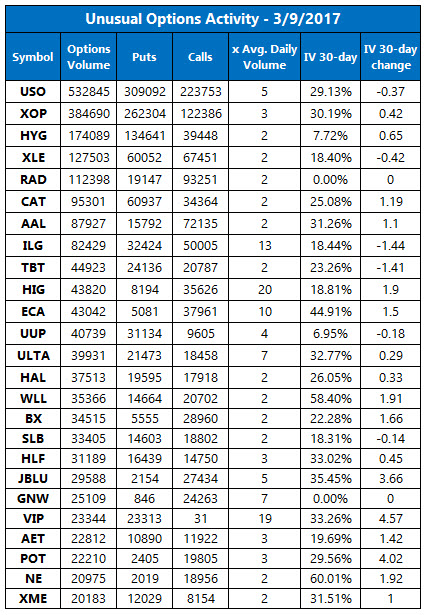

Data courtesy of Trade-Alert

Commodities

Oil prices fell to their lowest settlement price since November, as yesterday's U.S. crude inventories report called into question the effectiveness of global production cut efforts. April-dated crude futures lost $1, or 2%, to finish at $49.28 per barrel, breaching the psychologically significant $50 level.

Gold suffered an eighth straight loss and hit a five-week intraday low below the $1,200 mark, pressured by increasing March rate-hike expectations. By day's end, April-dated gold had given up $6.20, or 0.5%, to close at $1,203.20 per ounce.

Get your daily dose of Dow futures, stock news, and more with Schaeffer's Opening View.