The DJIA fell as financials faltered and Trump's dollar comments spooked investors

The Dow Jones Industrial Average was staring at a triple-digit deficit earlier, as President-elect Donald Trump's less-than-encouraging comments on the U.S. dollar sent the greenback tumbling, and the increased likelihood of a "hard Brexit" stoked geopolitical uncertainty. Floundering financial stocks only added more pressure ahead of a busy week of bank earnings. And while the Dow managed to pare some of these losses by the close, it still logged a third straight daily decline, while the Nasdaq Composite (COMP) retreated from record-high territory.

Continue reading for more on today's market, including:

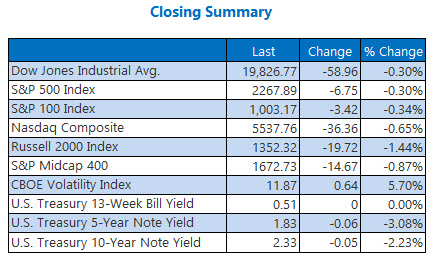

The Dow Jones Industrial Average (DJIA - 19,826.77) ended the day down 59 points, or 0.3%. Wal-Mart Stores Inc (NYSE:WMT) led the 14 Dow winners, with a gain of 1.9%, while Goldman Sachs Group Inc (NYSE:GS) fell the most of the 16 Dow losers, dropping 3.5%.

The S&P 500 Index (SPX - 2,267.89) also fell, shedding 6.8 points, or 0.3%, while the Nasdaq Composite (COMP – 5,537.76) slipped 36.4 points, or 0.7%.

The CBOE Volatility Index (VIX - 11.87) rose 0.6 point, or 5.7%.

5 Items on Our Radar Today

-

-

Deutsche Bank AG (USA) (NYSE:DB) has

agreed to a $7.2 billion settlement for its part in the 2008 mortgage-backed securities housing crisis. The fine includes a $3.1 billion civil penalty, as well as $4.1 billion in funds to be provided as relief to struggling homeowners, borrowers, and other communities negatively affected by DB's misleading lending practices.

(CNBC)

- The 4 events stoking accelerated call buying on the CBOE Volatility Index (VIX).

- 2 big banks to add to the earnings watch list.

- The $1.3 billion deal that helped this biotech surge 50% today.

Data courtesy of Trade-Alert

Commodities:

February-dated crude futures rose 11 cents, or 0.2%, to end the day at $52.48 per barrel. Signs that Saudi Arabia is adhering to the Organization of the Petroleum Exporting Countries' (OPEC) output deal and a falling dollar boosted black gold, although the commodity pared earlier gains on expectations of increased shale-oil production next month.

Gold prices gained ground, after the greenback retreated in the wake of Trump's comments. At the close, February-dated gold futures were up $16.70, or 1.4%, to finish at $1,212.90 per ounce.

Stay on top of overnight news & big morning movers. Sign up now for Schaeffer's Opening View.