DJIA futures are trading above fair value following last night's presidential debate

Dow Jones Industrial Average (DJIA) futures are signaling a positive open this morning, following a

disappointing opening week for the fourth quarter. Traders are digesting last night's U.S. presidential debate, which many believe kept the odds in favor of Democratic nominee Hillary Clinton. Stocks are also looking to feed off of rising oil prices, with November-dated crude futures trading 0.9% higher at $50.28 per barrel -- although questions remain surrounding an agreement among top oil producers to curb output.

Continue reading for more on today's market, including:

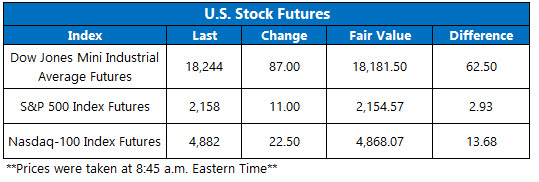

Futures on the Dow Jones Industrial Average (DJIA) are almost 63 points above fair value.

5 Things You Need to Know Today

- The People's Bank of China (PBOC) move that boosted Chinese stocks.

- The Chicago Board Options Exchange (CBOE) saw 634,927 call contracts traded on Friday, compared to 434,574 put contracts. The resultant single-session equity put/call ratio declined to 0.68, while the 21-day moving average stayed at 0.65.

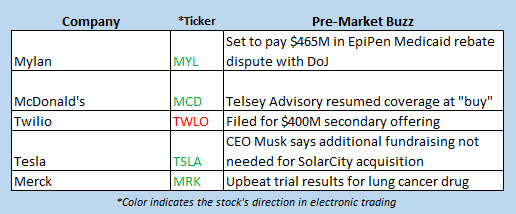

- Drug company Mylan NV (NASDAQ:MYL) has been getting pounded in the wake of the company's EpiPen controversy. Since their August peak north of $50, the shares have shed 28%, as analysts continue to slash their expectations. This morning, though, the stock is eyeing a major turnaround, adding 12% in electronic trading following news that MYL reached a $465 million settlement with the Department of Justice.

- Dow stock United Technologies Corporation (NYSE:UTX) is down 1.5% in pre-market trading, on pace to breach the recently supportive $100 level, after a downgrade to "neutral" at Citigroup. The shares fell on Friday, too, hurt by rival Honeywell International Inc.'s (NYSE:HON) disappointing outlook. As of Friday's close, UTX has lost 8.4% since its annual high of $109.83 on Aug. 15.

- TESARO Inc (NASDAQ:TSRO) is eyeing a 15% surge when the market opens, thanks to more positive news for its ovarian cancer drug, niraparib. This time around, the company reported the experimental drug improved the outcomes for all patients in its latest clinical study. A number of brokerage firms have since weighed in, including BofA-Merrill Lynch, which upgraded TSRO to "buy" from "neutral."

Earnings and Economic Data

There are no economic reports on today's slate, but Chicago Federal Reserve President Charles Evans will speak. There are also no notable earnings reports for the day. To see what else is coming up on this week's schedule, click here.

Don't miss the market's next move! Sign up now for Schaeffer's Midday Market Check